Back in 2008 — when the U.S. Secret Service raided Florida-based AdSurfDaily in a Ponzi probe and people who called ASD’s office were told God was on the company’s side — federal prosecutors alleged that ASD President Andy Bowdoin had “followers.”

The meaning of “followers” largely was left to the imagination. Much of the mystery was taken away, however, when a now-defunct cheerleading forum for Bowdoin known as “Surf’s Up” served up impossibly tortured defenses for the ASD patriarch around the clock for more than a year.

Although it’s hard to distill the peculiar essence of Surf’s Up in a single thought, this one at least approximates it: ASD = good; government = evil.

One Surf’s Up member advanced the notion that Bowdoin’s problems could be solved by a “militia” storming Washington. Another opined that the interests of justice best would be served if the then-lead federal prosecutor were placed in a torture rack and ASD members drew straws to determine who got the honor of turning the wheel. Another ASD member — on the seventh anniversary of the 9/11 attacks — issued a “prayer” for the prosecutors to be struck dead.

“Root them out of the land of the living!” the “prayer” petitioned. “Let evil slay them, and desolation be their lot!”

For good measure, the “prayer” called for God to order “divine angelic prophetic assaults . . .” against the prosecution and evidence in the case, including the ASD database.

Bowdoin himself removed some of the “followers” mystery when he compared a government raid designed to protect the financial interests of thousands of victims ensnared in an alleged $110 million Ponzi scheme to the 9/11 terrorist attacks that killed nearly 3,000 people. He further demonized the Secret Service and federal prosecutors by comparing them to “Satan.”

Another part of the mystery perhaps was decloaked when Bowdoin’s son — in 2010 — asserted his father “is a man with no conscience” who’d used religion for years to fleece the masses.

The government has filed at least three civil forfeiture actions related to ASD. Two of the cases have proceeded to final judgment, with ASD on the losing side. (A third civil forfeiture case remains pending. Elements of the third case are directed at certain specific ASD members who allegedly benefited from the fraudulent scheme, meaning that the members themselves may have significant legal exposure.)

In both cases that have proceeded to final judgment, Bowdoin unsuccessfully appealed the losses to a higher court. He filed one of the appeals, despite the fact he’d never entered a defense in that specific case. The case he did not defend is one in which certain members of Bowdoin’s family may have significant legal exposure.

Separately, Bowdoin was named a defendant in a lawsuit by disaffected ASD members who accused him of racketeering. By December 2010, Bowdoin had been arrested on ASD-related charges of wire fraud, securities fraud and selling unregistered securities. Although his trial date is set for September, he faces a bond-review hearing on Friday. Prosecutors now say they’ve linked Bowdoin to at least two post-ASD frauds, including one known as “OneX.”

Bowdoin began pitching OneX in October 2011, about 10 months after he was indicted in the ASD case.

“I believe that God has brought us OneX to provide the necessary funds to win this case,” Bowdoin said last year.

Both Bowdoin and supporters habitually use pronouns such as “us” and “we”when discussing ASD or matters pertaining to Bowdoin. The precise reason why remains unclear. So far, Bowdoin is the only ASD figure known to have been charged publicly for alleged misconduct directly tied to ASD, which the Secret Service described as a “criminal enterprise.”

Bowdoin’s reference in his OneX sales pitch to “this case” was in the context of the ASD-related criminal case against him. He earlier blamed the loss of the ASD civil cases on a “single, lone judge,” prosecutors/agents who’d allegedly “crucified” him and earlier defense attorneys who’d allegedly railroaded him.

Did we mention that some ASD members have accused a federal judge of “treason” and that purported “sovereign citizen” Kenneth Wayne Leaming — an ASD story mainstay — is jailed near Seattle on federal charges that he filed false liens against at least five public officials involved in the ASD case?

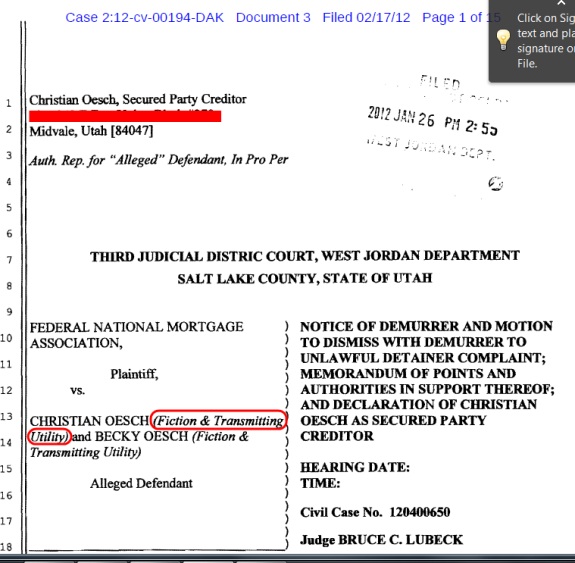

Meanwhile, Christian Oesch, a Leaming colleague in a failed lawsuit against the government for alleged misdeeds in the ASD case, strangely has taken to calling himself a “transmitting utility” in response to a nonASD lawsuit in which he is named a defendant.

Records in Washington state show that at least two companies that use the phrase “transmitting utility” in their names have a business tie to Leaming through an entity known as American-International Business Law Inc. Other records show that the phrase itself has been linked to the so-called sovereign-citizen movement. “Sovereign citizens” have an irrational belief that laws do not apply to them.

When Leaming was arrested by an FBI terrorism task force in November 2011, he was found with two federal fugitives from Arkansas, according to court filings. Leaming also allegedly discussed a plan by which he’d serve John Roberts with a writ through the school his young children attended. That writ apparently was part of a scheme to file false liens against two U.S. prison officials for alleged misdeeds against a former Leaming business colleague serving time in a federal penitentiary.

John Roberts is the Chief Justice of the United States.

And yet Bowdoin — despite everything that has happened to date in the ASD case and its surrounding circus of the bizarre — still has followers.

The PP Blog received information through a source last night that some of Bowdoin’s followers will continue on with OneX, despite the government’s recent assertion it is a “fraudulent scheme” and “pyramid” that is recycling money to members in ASD like fashion.

An email circulating last night from Bowdoin’s OneX “team” strangely referenced Bowdoin without naming him. The email used the pronouns “our” and “we.”

“As many have noticed our Mentor has had to take a break due to legal reasons,” the email read in part. “We had hoped for a breakthrough on the 8th, however it was postponed to later this month.”

Bowdoin’s bond-review hearing originally had been scheduled for May 8. A federal judge later rescheduled it for May 18 — Friday.

That Bowdoin — an accused felon with a felonious history — gets accorded the description of “Mentor” (with an uppercase “M”) hardly can be a source of comfort to the good men and women at the Department of Justice and the U.S. Secret Service. Agents and prosecutors alike must be scratching their heads today and wondering where it all will end.

Here is the OneX email in its entirety (italics added):

Ninja Success Team Updates

Dear Team,

As most know we have been going through some changes with the Ninja Success Team. As many have noticed our Mentor has had to take a break due to legal reasons. We had hoped for a breakthrough on the 8th, however it was postponed to later this month.

I have gotten a lot of emails in the last week and I hope that my honesty has made you feel at ease and I hope that you will find patience until the challenge has been met.

Another challenge that we are facing is the financing of the servers that everybody’s Lead Capture Page Systems, the 1xTraining Site, and the Ninja Back Office sit [sic]. Our Mentor has been paying this out of his own pocket for all time. Because of the legal challenges, we are left to finance ourselves.

The management team has been tossing around a bunch of ideas, from donations to selling the lead packages. We have decided to ask for donations as well as to continue to sell the new ninja tools (which are getting awesome results).

As we all know we are at a very big momentum right now and are at the downhill roll to making all of our business worth quite a bit of money and this is due to the working of our Ninja Success Team. In order to continue as one of the biggest, most successful teams of the OneX opportunity, I implore everybody to at least make a donation or purchase of the New Ninja Turbo tools available on the training site or the Ninja Back Office.

Below is the link to make a donation or you can find on the menu part of the Training Site. A donation of $10 or $20/mon. would be extremely welcome.

[Link deleted by PP Blog]

I want to personally thank everybody as well for the patience they have shown during this challenge.

Alan

The Ninja Success Team

If the government is right, it means that Bowdoin is pushing a pyramid scheme even as he awaits trial in a major Ponzi scheme case.

And if purported email author and OneX pitchman “Alan” is right, then the Bowdoin “team” is getting “awesome results” from selling “tools” to drive traffic to a program the government says is a pyramid scheme.

“Alan” apparently does not feel compelled to pull the plug on the Bowdoin “team” OneX promos even though the “Mentor” possibly faces severe bond restrictions or potentially even loss of his freedom owing to the pitches.

What’s important to “Alan,” apparently, is that the “breakthrough” now is expected to come through on May 18 after a 10-day delay.

Whether the judge conducting the bond-review hearing might have a differing notion on the meaning of the word “breakthrough” is a question that may be answered in the coming days.

In any event, “followers” — a word used by the ASD prosecutors long ago — proved to be pretty much spot on. What no one knew at the time was that not even three forfeiture cases, a racketeering lawsuit, an arrest on serious criminal charges and Bowdoin’s own felonious history could deter some of those followers from seeing him as anything other than a mentor.