UPDATED 10:22 P.M. EDT (U.S.A.) The purported TelexFree “opportunity” is under investigation by multiple agencies in Brazil, its purported base of operations despite competing claims the company is headquartered in the United States. The notes below concern TelexFree’s U.S. presence and positioning. They are presented in no particular order of importance. TelexFree says it is in the communications business.

TelexFree has a footprint in Massachusetts at 225 Cedar Hill Street, Suite 200, Marlborough. It is a shared office facility. Ads for the building suggest a conference room with video capabilities can be rented by the hour. One suggested use of the room is for attorneys to rent it to conduct depositions. Some attorneys practicing in the state and federal courts use the building as a business address.

Other lessees include the Massachusetts Library System (MLS), which describes itself as “state-supported collaborative” to foster “cooperation, communication, innovation, and sharing among member libraries of all types.” MLS uses Suite 229, according to its website.

TelexFree operates as an MLM. One of the problems in the MLM sphere is that purported “opportunities” and their promoters have been known to dupe participants by leasing virtual office space to create the illusion of scale or of a massive physical presence. Such was the case with a Florida entity associated with AdViewGlobal, an AdSurfDaily knockoff scam that purported to pay 1 percent a day. As the PP Blog reported on May 31, 2009 (italics added):

Research suggests a company with which AVG has a close association is headquartered in a modern office building in the United States. The building was constructed in 2003. Office functions and conferencing can be rented by the hour. Two large airports are nearby, and a major Interstate highway is situated one mile from the building.

It is a virtual certainty that AVG, which purported to operate from Uruguay, actually was operating from the U.S. states of Florida and Arizona and using a series of business entities to launder the proceeds of its fraud scheme. AVG disappeared mysteriously in June 2009.

On Dec. 14, 2011, the PP Blog reported that Text Cash Network (TCN) — another purported MLM “opportunity” — was using a virtual office in Boca Raton, Fla., in a bid to create the illusion of scale. TCN promoters published photos of a glistening building with TCN’s name affixed near the crown of the building. The Boca Raton Police Department, however, said the firm’s name did not appear on the building.

Although the PP Blog is unaware of any bids to Photoshop TelexFree’s name on a large office building, affiliates have shared photos of TelexFree President James M. Merrill posing in front of the large Massachusetts building. So there can be no confusion, TelexFree does not own the building. TelexFree affiliates/prospects should not rely on the photo of the building as proof of the legitimacy of the company. The photo itself raises questions about whether Merrill and TelexFree were trying to create the illusion of scale. Even though the answer could be no, the negative inferences that can be drawn from the photo contribute to MLM’s reputation for serial disingenuousness.

TelexFree also has a presence in the state of Nevada. Records show that an entity known as TelexFree LLC is listed as “Domestic Limited-Liability Company” situated in Las Vegas. Listed managers include Carlos N. Wanzeler, Carlos Costa and James M. Merrill. TelexFree operates in Massachusetts with an “Inc.” version of the name — i.e., TelexFree Inc., having undergone a name change in February 2012 from Common Cents Communications Inc. In Massachusetts, James Merrill is listed as the registered agent, president, secretary and director of the firm, with Carlos Wanzeler listed as treasuer and director. Unlike the Nevada “LLC” version of TelexFree, Carlos Costa appears not to hold a title in the Massachusetts “Inc.” entity.

The footprints in the United States are important in the sense that they establish a business presence in the country should TelexFree become the subject of U.S. investigations akin to what is happening now in Brazil, where pyramid-scheme and securities concerns have been raised. Along those lines, records of the Financial Industry Regulatory Authority (FINRA) appear not to list TelexFree — despite the fact affiliates in the United States have claimed members acquire “stock” from TelexFree that can be sold through TelexFree and that affiliates purchase “contracts” from TelexFree.

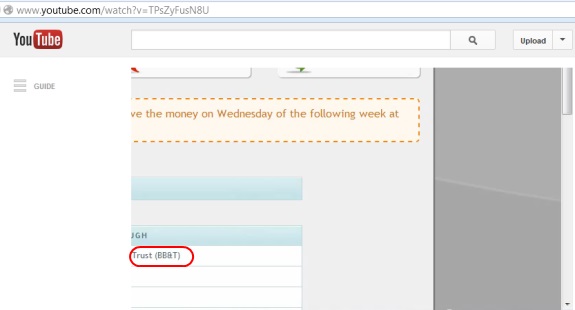

One YouTube video viewed by the PP Blog shows a TelexFree affiliate purportedly cashing out his stock through his TelexFree back office. The affiliate appears to be speaking in U.S. English, citing the date as March 19, 2013. In the video, the affiliate describes his pitch as a “quick withdrawal video” — i.e., proof that TelexFree is legitimate because it pays.

“OK,” the narrator intones. “I’m going to sell all my stock.” The video shows a tab labeled “Stock” and a subtab styled “Repurchase” in the back office.

The narrator then clicks on a series of graphics styled “REPURCHASE” and tells the audience that he wants to show it all the “stock that I have that converts to actual money.” He then proceeds to a “Withdraw” subtab under a “Statement” tab. These actions eventually expose a screen that shows an “AVAILABLE BALANCE” of $927.61 for withdrawal.

For a brief moment, the acronym “BT&T” flashes on the screen, suggesting the TelexFree affiliate is seeking to have his earnings from stock sales relayed through North Carolina-based Branch Banking & Trust. The interesting thing about that is that the alleged $600 million Zeek Rewards Ponzi- and pyramid scheme claimed it had a banking relationship with BB&T.

In May 2012 — on Memorial Day — Zeek mysteriously announced it was ending its relationship with BB&T. It was unclear from the TelexFree affiliate’s video whether he was a BB&T customer or whether TelexFree was. What is clear is that the SEC moved against Zeek in August 2012, accusing the company of securities fraud and selling unregistered securities as investment contracts. The U.S. Secret Service said it also was investigating Zeek.

Among the problems with HYIP schemes is that banks can become conduits through which illicit proceeds are routed or stockpiled. Zeek used at least 15 domestic and foreign financial institutions to pull off its fraud, according to court filings.

Because HYIPs offer commissions to members who recruit other members along with “investment returns,” legitimate financial institutions can come into possession of money tainted by fraud.

Like Zeek (and AdViewGlobal and AdSurfDaily), TelexFree has a presence on well-known forums listed in U.S. court records as places from which Ponzi schemes are promoted.

TelexFree shares some of the characteristics of fraud schemes such as Zeek, AdViewGlobal, AdSurfDaily, Profitable Sunrise and others. ASD, AVG and Zeek, for instance, had a purported “advertising” element. So does TelexFree.

TelexFree affiliates claim they get paid for posting ads online for the purported “opportunity.” Zeek affiliates made the same claim.

It is highly likely that Zeek and TelexFree have promoters in common, a situation that potentially is problematic, given that some affiliates may have used money from Zeek to join TelexFree — and the court-appointed receiver in the Zeek case is pursuing clawbacks against “winners.” In short, some of the winnings could have been spent in TelexFree.

An online promo for Zeek in July 2012 claimed North Carolina-based Zeek had 100,000 affiliates in Brazil alone. TelexFree affiliates are claiming that their “opportunity” now has hundreds of thousands of affiliates, which suggests TelexFree has achieved Zeek-like scale. Whether it enjoys Zeek-like, money-pulling power on the order of $600 million is unclear.

What is clear is that TelexFree, like Zeek before it, is spreading in part through the posting of promos on classified-ad or similar sites across the United States. Profitable Sunrise, another HYIP, spread in similar fashion. Dozens of U.S. states issued Investor Alerts or cease-and-desist orders against Profitable Sunrise, which the SEC accused of fraud in April 2013.

To gain an early sense of the scale TelexFree may be achieving in the United States, the PP Blog typed into Google the term “TelexFree” and the names of several U.S. states known to have taken actions against Profitable Sunrise. This revealed URLs such as “TelexFreeOhio” and “telexfreetexas.blogspot.com,” for two examples. It also showcased classified-ad (or similar) sites on which TelexFree promos are running or have run.

Finally, the state of Massachussets was the venue from which the prosecutions of the infamous World Marketing Direct Selling (WMDS) and OneUniverseOnline (1UOL) pyramid-schemes were brought in federal court. Those fraud schemes were targeted at Cambodian-Americans. The state does not take kindly to affinity fraud. In March, Massachusetts securities regulators charged a man in an alleged fraud bid against the Kenyan community.

Among the claims of the MLM hucksters pitching WMDS and 1UOL was that members could purchase an income. Some TelexFree affiliates are making similar claims.

The WMDS and 1UOL frauds became infamous as the source of death threats, including one against a federal prosecutor.

Media outlets in Brazil have reported that death threats have surfaced over the TelexFree scheme.

For the reasons cited above and more, it would be surprising if things end well in the United States for TelexFree, which has Zeek and ASD-like signatures of MLM disasters waiting to happen.