URGENT >> BULLETIN >> MOVING: Carlos Wanzeler refused to resign from TelexFree-related entities and has been fired by interim CEO Stuart A. MacMillan, according to new filings in the TelexFree bankruptcy case.

MacMillan also caused the resignations of former TelexFree President James Merrill and interim CFO Joe H. Craft, according to the filings. MacMillan now is controlling the TelexFree businesses.

“Mr. Merrill, Mr. Wanzeler and Mr. Craft no longer have access to the Debtors’ facilities and their access to the Company’s email has been terminated,” MacMillan advised U.S. Bankruptcy Judge August B. Landis of Nevada. “I am the only person authorized to act as a signatory on any bank account that the Debtors have or may have.”

Whether the moves would satisfy the SEC and the U.S. Bankruptcy Trustee, however, was far from clear early this morning. Tracy Hope Davis, the trustee, alleged last week that there were “reasonable grounds” to believe that “criminal conduct” occurred at TelexFree.

Among the Davis allegations was that “[t]wo companies controlled by Craft received more than $2,010,000.00 between November 19, 2013 and March 14, 2014.” She also contended that “[t]he modus operandi of Merrill and Wanzeler and their cohorts suggests that it is more likely than not that anyone handpicked by them to manage their wholly owned companies will be another cohort.”

MacMillan advised Landis today that “I did not have a pre-existing relationship with the Company, Mr. Wanzeler or Mr. Merrill prior to this initial engagement by TelexFree.”

Whether he had a preexisting relationship with Craft was not immediately clear.

Davis is seeking the appointment of a trustee, a process that could put the firm on the path toward liquidation, rather than reorganization under Chapter 11.

The firing of Wanzeler and the resignations of Merrill and Craft, according to MacMillan, occurred on April 17, a day after the SEC alleged that Craft was in the TelexFree office in Massachusetts with nearly $38 million in cashier’s checks and sought to leave the premises with the checks while a federal raid was under way.

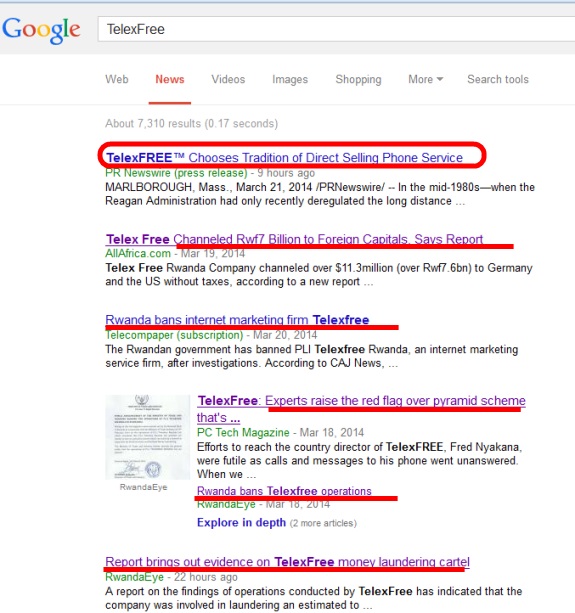

News of the management maneuvers came on the same day it was learned that the state of Montana had halted TelexFree, alleging that it was unable to obtain complete and accurate information from the MLM company after months of trying. Other states are questioning TelexFree’s ability to provide telecom service

In a separate filing in bankruptcy court today, TelexFree pledged to “cooperate with the SEC and the Massachusetts Securities Division in their ongoing investigations related to the Debtors and prosecutions against third parties, including the Debtors’ former employees and equity holders of TelexFree Nevada and TelexFree Massachusetts.”

Wanzeler and Merrill are the asserted equity holders. They, along with Craft and TelexFree marketing director Steve Labriola, were charged with fraud April 15 by the SEC. Four alleged TelexFree pitchmen also were charged with fraud.

Despite the pledge to cooperate, TelexFree is resisting the SEC’s bid to transfer the bankruptcy case from Nevada to Massachusetts.

From an assertion today by TelexFree (italics added):

The Debtors chose the Nevada Bankruptcy Court because inter alia TelexFree Nevada, a Nevada entity, is a counter-party to more than 700,000 contracts governed by Nevada law. The Debtors anticipate that nearly all of the claims against the Chapter 11 estates will result from these contracts. Although both Nevada and Massachusetts residents will be asserting some of these claims, the Debtors’ creditor base resides all over the world. Some 90% of the creditors reside outside Nevada and Massachusetts. In fact, approximately three-quarters of the creditors are from foreign countries.

MacMillan also suggested today that Wanzeler and Merrill owned TelexFree Dominicana, a company to which a cashier’s check for more than $10 million was made out just days before the April 13 bankruptcy filing. The check and nine others, including one for more than $2 million made out to Wanzeler’s wife, were seized by federal agents on April 15, after being found in Craft’s possession.

MacMillan said he did not believe that “Mr. Craft was attempting to divert any of the Debtors’ cash or other resources.

“Instead,” MacMillan continued, “he was acting at the direction of Mr. [William] Runge and me to secure the cashier’s checks in a safe and reliable location for the benefit of the Debtors’ constituencies.”

Runge, a turnaround specialist, is TelexFree’s chief restructuring advisor.

MacMillan, in his declaration today, said it was his “understanding” that TelexFree “struggled to maintain a consistent cash management system.

“It is also my understanding that on or about March 14, 2014, Wells Fargo Bank, N.A. . . . notified the Debtors that Wells Fargo was closing their depository account and that the Debtors needed to remove their cash on deposit.”

This may be the cash that was used to acquire the cashier’s checks. Regardless, the account closures signaled serious trouble for TelexFree, which the SEC and the Massachusetts Securities Division alleged have a history of not disclosing important information to members.

The assertion by MacMillan potentially means that TelexFree continued to gather money from both existing participants and new recruits after one of its key vendors notified it that an account was being closed.

Beyond that, if Merrill and Wanzeler owned a company in the Dominican Republic, it could lead to questions about whether they owned other firms in offshore venues and diverted money to those entities.

The same circumstance of account closures by major vendors arose in both the AdSurfDaily Ponzi scheme in 2008 and the Zeek Rewards Ponzi scheme in 2012.