EDITOR’S NOTE: The PP Blog first reported on the arrest in France of alleged international fraudster Vladislav Anatolievich Horohorin on Aug. 11, 2010. The arrest came as the result of an undercover operation the U.S. Secret Service conducted on online forums.

As the Blog reported at the time, “The arrest of Vladislav Horohorin is notable on a number of levels. First, the arrest in Europe was a result of an online fraud scheme that allegedly crossed international borders and made its way to the United States, where criminal charges were filed. At the same time, the crime allegedly involved the transfer of money though international payment processors. Perhaps more than anything, however, the case against Horohorin demonstrates that the U.S. Secret Service is “plugged into” forums that promote international lawlessness. His arrest is very bad news for credit-card crooks and HYIP and autosurf Ponzi schemers — and their corrupt colleagues.”

Today the PP Blog is reporting that the United States successfully arranged the extradition of Horohorin. His first court appearance was made in the District of Columbia, the venue from which the AdSurfDaily Ponzi case brought by the Secret Service is playing out. The office of U.S. Attorney Ronald C. Machen Jr., which was instrumental in guiding the ASD case, is in charge of certain elements of the Horohorin case.

The office of U.S. Attorney Sally Quillian Yates of the Northern District of Georgia also is handing elements of the Horohorin prosecution.

The allegations in the case are alarming: “According to the indictment filed in the Northern District of Georgia, Horohorin was one of the lead cashers in an elaborate scheme in which 44 counterfeit payroll debit cards were used to withdraw more than $9 million from over 2,100 ATMs in at least 280 cities worldwide in a span of less than 12 hours,” the Justice Department said in a statement. “Computer hackers broke into a credit card processor located in the Atlanta area, stole debit card account numbers, and raised the balances and withdrawal limits on those accounts while distributing the account numbers and PIN codes to lead cashers, like Hororhorin, around the world.”

** ______________________________________ **

UPDATE: Alleged international credit-card fraudster Vladislav Anatolievich Horohorin, also known as “BadB,” is in an American jail after an undercover probe on online forums by the U.S. Secret Service and a parallel investigation by the FBI.

“We are pleased that he has been extradited to the United States to face these criminal charges in a District of Columbia courtroom,” said U.S. Attorney Ronald C. Machen Jr. of the District of Columbia. “This prosecution demonstrates that those who try to rip off Americans from behind a computer screen across an ocean will not escape American justice.”

Horohorin, whose age was listed as 27 after his August 2010 arrest in France on U.S. charges, also will be prosecuted in U.S. District Court for the Northern District of Georgia.

“International cyber criminals who target American citizens and businesses often believe they are untouchable because they are overseas,” said U.S. Attorney Sally Quillian Yates of the Northern District of Georgia. “But as this case demonstrates, we will work relentlessly with our law enforcement partners around the world to charge, find and bring those criminals to justice.”

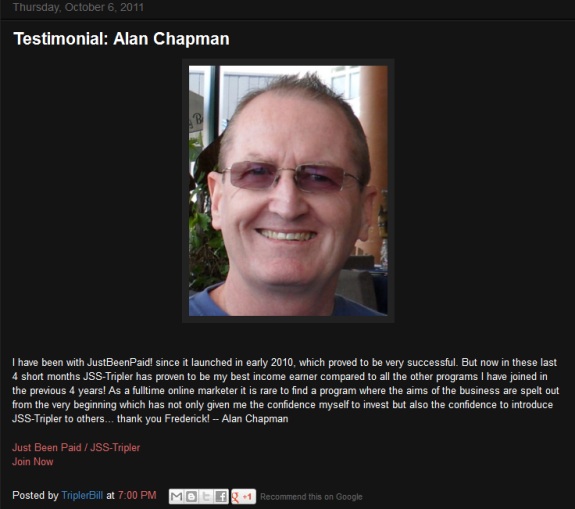

News of Horohorin’s extradition by France to U.S. soil occurred against the backdrop of claims by an HYIP “program” known as JSS Tripler/JustBeenPaid that members must affirm they are not with the “government” and that the “program” is not located in any “unfriendly political jurisdictions.”

A JSS/JBP “defender” known as “MoneyMakingBrain” asserted in March that “law enforcement agencies don’t pay attention to what’s being said on forums and blogs.” The claim was at odds with various public records that show U.S. law enforcement pays close attention to forums and Blogs and even conducts undercover operations by infiltrating forums.

Among other things, “MoneyMakingBrain” asserted he’d defend JSS/JBP’s purported operator Frederick Mann “so help me God.” The PP Blog became the subject of threats from “MoneyMakingBrain.” JSS/JBP, which uses offshore payment processors, purports to provide a return of 60 percent a month, has no known securities registrations and may have ties to the “sovereign citizens” movement.

Underscoring the importance of the Horohorin arrest and extradition, Machen and Yates were joined in the announcement by the head of the U.S. Department of Justice’s Criminal Division and top officials from both the U.S. Secret Service and the FBI.

Horohorin, said Assistant Attorney General Lanny Breuer, was “one of the most notorious credit card traffickers in the world.”

“Due to our strong relationships with our international law enforcement partners, we secured his extradition to the United States, where he now faces multiple criminal counts in two separate indictments,” Breuer said. “We will continue to do everything we can to bring cybercriminals to justice, including those who operate beyond our borders.”

A top U.S. Secret Service official, meanwhile, said the agency viewed the alleged Horohorin caper as an “attack” on America’s financial system.

“The Secret Service is committed to identifying and apprehending those individuals that continue to attack American financial institutions and we will continue to work through our international and domestic law enforcement partners in order to accomplish this,” said David J. O’Connor, assistant director of investigations.

In addition to providing security for the President of the United States, the Secret Service is in charge of protecting America’s financial infrastructure. The agency has described AdSurfDaily as a “criminal enterprise,” with the Justice Department asserting that ASD was an example of an “insidious” business that permitted fraud to spread globally.

Just two days after Horohorin’s first appearance in a U.S. courtroom in the District of Columbia, AdSurfDaily members Todd Disner and Dwight Owen Schweitzer claimed that the federal prosecutors who brought the ASD Ponzi case in August 2008 had gone shopping for a “frendly [sic] forum” in which the government could enlist “some of their Washington D.C. operatives to become members of ASD, thereby making them potential witnesses.”

Disner and Schweitzer sued the United States in November 2011 for alleged misdeeds in the ASD case. Among other things, Disner and Schweitzer asserted that undercover agents who joined ASD had a duty to inform ASD management. The Secret Service described ASD as a massive online Ponzi scheme involving at least $110 million. ASD President Andy Bowdoin pleaded guilty to wire fraud last month, admitting ASD was a Ponzi scheme and that the company never operated legally from its inception in 2006.

Disner and Schweitzer now are affiliates for Zeek Rewards, a “program” that plants the seed it can provide an ASD-like return of 1 percent or more per day without being a pyramid scheme and without constituting an investment opportunity. The payout Zeek plants the seed it can provide is on par with the returns advertised by JSS Tripler/JustBeenPaid, which does not disclose its base of operations.

A top FBI official said the arrest of Horohorin showed that international agencies are working together to divorce criminals from their abilities to use computers to reach across borders to pull off egregious crimes.

“Horohorin’s extradition to the United States demonstrates the FBI’s expertise in conducting long-term investigations into complex criminal computer intrusions, resulting in bringing the most egregious cyber criminals to justice, even from foreign shores,” said Brian D. Lamkin , special agent in charge of the Atlanta division. “The combined efforts of law enforcement agencies to include our international partners around the world will ensure this trend continues.”

Court and other records show that Horohorin, like ASD, had a presence in both the District of Columbia and the Northern District of Georgia.