Many people in the antiscam community applauded Kenneth D. Bell, the receiver for Zeek Rewards, when he sued more than 9,000 individuals more than two years ago for return of their gains from the scheme. Those gains — more than $200 million — came from Ponzi proceeds, Bell alleged.

And he pointed out that the money rightfully should go to the hundreds of thousands of Zeekers globally who were “affiliate victims.” Court filings later would show that Zeek gathered on the order of $940 million in less than two years. Only TelexFree, another MLM HYIP scheme that was disintegrating when Bell announced his lawsuit against the Zeek “winners” in March 2014, may be bigger.

More than 90,000 (gulp!) alleged TelexFree winners now are being sued by Trustee Stephen B. Darr. TelexFree infamously caused angry affiliates to pour into the company’s billion-dollar broom closet in Massachusetts. It was a good thing police were there to keep order.

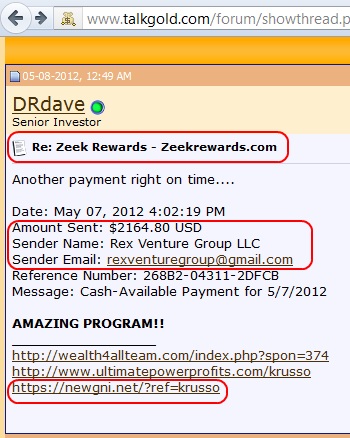

Thanks to the willful blindness and serial disingenuousness brought to you by serial MLM HYIPers such as Todd Disner, T. LeMont Silver and “Ken Russo,” huge class-action cases in which “winning” promoters of MLM securities schemes are named defendants now are a reality.

Bell, unfairly maligned among some MLM HYIPers and even some apparent “sovereign citizens,” deserves a lot of credit for trying to bring a measure of financial justice to the hundreds of thousands of individuals ripped off by Zeek and for establishing a sort of blueprint for how Darr could proceed.

This blueprint also is there in case the Traffic Monsoon receiver needs it. Traffic Monsoon, an alleged $207 million scheme, was broken up by the SEC last month. There already is evidence that Traffic Monsoon had promoters in common with TelexFree.

It is true that the number of potential defendants across the HYIP sphere is staggering. But it is equally true that the number of victims of these cross-border schemes is even more staggering. This number is in the millions. The global losses are in the billions. Absent actions such as those brought by Bell and Darr, however, there would be virtually no financial accountability. Society would be saying that it’s OK to profit through the promotion of online Ponzi schemes.

For years, the PP Blog has raised questions about the national-security implications of cross-border HYIP schemes. The narratives surrounding such schemes typically are bizarre, with anonymous Ponzi-board pitchmen typically beginning with “I am not the admin” of the “program.” It all goes recklessly downhill from there.

To those who feel a chill every time one of these schemes gains a head of steam, it came as no surprise that the alleged Zeek “winners” are arguing they should get to keep their hauls. It is simply the natural progression of the HYIP narrative.

Bell, a former federal prosecutor, is having none of this. Indeed, his is the voice of common sense.

From his argument (italics/bolding added):

Defendants still act as if Zeek was a legitimate business and Defendants were “internet marketing specialists” entitled to be paid as employees rather than investors in the scheme, all of which is of course pure fiction.

Specifically, Defendants ask the Court to absolve the scheme’s net winners from their obligation to repay the victims’ money because of an alleged “limitation” on the timing of future claims included in the scheme’s website’s “Terms of Service” (or “TOS”), which in any event do not limit the Receiver’s claims against Defendants. The Court should resist Defendants’ invitation to create the dangerous loophole of allowing a fraudster to use the terms implementing a Ponzi scheme to limit the right of a subsequently appointed Receiver to recover funds paid to the winners of the fraudulent scheme. While such a rule would be a great recruiting tool for future Ponzi scheme operators, it is surely an unacceptable legal rule and public policy.

Also, Defendants urge the Court to rule that by purchasing bids, posting online advertisements (which Zeek boasted would take only three to five minutes a day), and recruiting thousands of victims to the scheme, they provided “reasonably equivalent value” to ZeekRewards such that they get to keep the victims’ money that they won in the scheme. In other words, Defendants claim that those Defendants who spent the most time successfully promoting the scheme and multiplying the number of its victims should be given the most credit against the Receiver’s claims to recover their fraudulently transferred winnings. In fact, in arguing that they were supposedly rightly paid for their “services,” Defendants stretch to compare themselves to the utility company, which among many other differences does not invest money in their customers’ businesses hoping to share in compounding profits of 125% every ninety days.

NOTE: Our thanks to the ASD Updates Blog.