The HYIP world is known for promoters’ bids to change the storyline, but this one may take the cake — or at least be a sweet complement.

The HYIP world is known for promoters’ bids to change the storyline, but this one may take the cake — or at least be a sweet complement.

There are reports in Brazilian media that a promoter of the TelexFree MLM scheme — alleged to be a massive pyramid — has named an ice cream after TelexFree to show support for the embattled firm.

“The ice cream is not a pyramid,” a person was quoted as saying in DiarioDigital, according to a translation — and neither is its namesake.

Here is a link to the story in Portuguese; here is a link to the English translation by Google Translate.

Recruitment by TelexFree is banned in Brazil while investigations by at least seven Brazilian states proceed. Payments to Brazilian participants by TelexFree likewise are blocked. The purported “opportunity,” however, still is operating in other countries and apparently gathering money and issuing payments.

Separately, Veja.com is reporting that undercover investigators in Brazil have noticed that some Brazilian promoters of TelexFree have crossed national borders into Bolivia and Paraguay to keep TelexFree investment money flowing. Here is a link to the story in Portuguese; here is the link to the English translation by Google Translate.

The United States long has warned about cross-border fraud such as was present in PathwayToProsperity, an alleged $70 million Ponzi scheme whose operator is listed by INTERPOL as an international fugitive. P2P, as the “program” was known, made its way across multiple continents and 120 countries, according to court filings.

Meanwhile, U.S. promoters of TelexFree have been busy watching a promoter’s Aug. 16 YouTube video titled, “How to register your GPG account with TelexFree.”

GPG, according to the video, stands for Global Payroll Gateway.

The company, according to its website, provides services such as loading payrolls onto debit cards. TelexFree, according to the affiliate’s video, is now a GPG client and TelexFree affiliates must “connect” their account to GPG to get paid.

A screen shown in the TelexFree affiliate’s video shows an apparent executive of TelexFree announcing that the changeover to GPG’s services “is causing a delay in our payment process for the first run.”

The FBI long has warned that certain types of debit cards can be abused and that a “shadow banking system” is playing a role in fraud schemes that affect national security.

If TelexFree is adjudicated a scam, it may be difficult for the governments of the world or the receivers/trustees they may appoint to gather proceeds for victims. HYIP money may dissipate quickly, perhaps particularly quickly if it is offloaded with debit cards. In a money-laundering case brought in 2008, federal prosecutors in Connecticut said that millions of dollars in narcotics proceeds were offloaded at ATMs in Colombia.

Robert Hodgins, a Canadian currently listed by INTERPOL as an international fugitive in the Connecticut money-laundering case, reportedly supplied the debit cards through a firm known as Virtual Money Inc. and had ties to the HYIP world and schemes such as PhoenixSurf and AdSurfDaily.

Another screen in the TelexFree affiliate’s video shows folders with titles such as “telexfree,” “Banner[s] Broker, “hyip monitors,” “forex”and “Passive peeps.”

The context of the folders shown in the video is unclear. Banners Broker, however, is a bizarre HYIP scheme. HYIP monitors are websites that monitor whether a particular HYIP site is “paying.” Meanwhile, the word “passive” often is used in HYIP scams that promote tremendous returns for investors inclined to sit back and wait for the payments to flow in, instead of recruiting other investors to earn downline commissions from a “program.”

TelexFree has been promoted on well-known Ponzi scheme forums such as TalkGold and MoneyMakerGroup. The names of both forums appear in U.S. court filings as places from which fraud schemes are advanced.

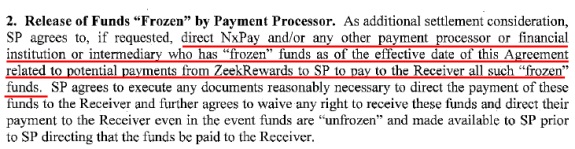

Zeek Rewards, an alleged $600 million Ponzi- and pyramid scheme that had a Ponzi-forum presence and became the target of an SEC action last year, was promoted as a “passive” program. Like Zeek, TelexFree purportedly has a requirement that participants post ads for the “program” online.

There have been reports in Brazil that a judge and prosecutor involved in the TelexFree case have been threatened with death.

But not even those disturbing reports were enough to cause TelexFree to cancel a rah-rah event in California last month. The company says it also plans an “at sea” event in December. Earlier, some TelexFree pitchmen provided AdSurfDaily-like coaching tips to enrollees, especially on matters of how to speed the flow of money to the company.

ASD was a $119 million MLM Ponzi scheme broken up by the U.S. Secret Service in 2008. Like Zeek and TelexFree, the ASD “program” also had a Ponzi-forum presence and was promoted as an opportunity for “passive” participants.

Some TelexFree promoters in Brazil appear to believe that TelexFree has been deemed legal in the United States by the U.S. government. This errant belief may in part have been instilled by promoters of TelexFree who worded MLM HYIP pitches to suggest that the U.S. government had authorized the “program.”

Some TelexFree promoters have claimed a payment of $15,125 to the firm will fetch a return of more than $42,000 in a year. Even the cautious “Aunt Ethels” of the world will grow to become keen on TelexFree, according to a promo.