EDITOR’S NOTE: The personnel information in the first section below is gleaned from public records in the SEC’s pyramid- and Ponzi case against the “Achieve Community” and alleged principals Kristi Johnson and Troy Barnes. Some of the numbered points include additional notes by the PP Blog. These notes are based on public records or information in the public domain, including a Feb. 18 statement by the SEC.

**___________________**

The U.S. Securities and Exchange Commission announced on Feb. 18 it had filed a pyramid- and Ponzi complaint that alleged securities fraud against “Achieve Community” and that a federal judge had granted an emergency asset freeze.

The U.S. Securities and Exchange Commission announced on Feb. 18 it had filed a pyramid- and Ponzi complaint that alleged securities fraud against “Achieve Community” and that a federal judge had granted an emergency asset freeze.

Supporting documents filed by the SEC paint a picture of significant legwork that took place at the agency as it studied how Achieve had evolved from its alleged start in April 2014 through the days immediately prior to the freeze. This column focuses on human assets, the public servants who played a role in stopping the harm caused by Achieve by applying their individual specialties.

The SEC assigned (at least) the following individuals to the case prior to filing a complaint under seal against Achieve and requesting an emergency asset freeze on Feb. 12:

1.) An IT specialist assigned to the Division of Enforcement in Washington, D.C. This person performed website/video-capture duties involving public sections of two Achieve sites (TheAchieveCommunity.com and ReadyToAchieve.com) and at least one YouTube video. (Longtime readers will recall the 2012 Zeek Rewards probe that led to spectacular allegations of pyramid-and Ponzi fraud also involved website capture.)

2.) A senior paralegal employed by the Division of Enforcement and assigned to the SEC’s Denver Regional Office. This person reviewed and transcribed 11 Achieve-related public video files and one public audio file. Some of the video files were on the Achieve sites. Others were on YouTube. The audio file was on the Achieve site. (A segment of a transcript shown a federal judge from the audio file shows “Rodney” serving up softball questions to Kristi Johnson and Troy Barnes, Achieve’s accused operators. The segment was on the topic of Achieve’s purported “triple algorithm.” It is referenced in “Exhibit D.” The screen shot that introduces this column is from a pdf of Exhibit D. More from Exhibit D appears in the form of a screen shot below.)

3.) An attorney/investigator employed by the Division of Enforcement at the SEC’s Denver Regional Office. This attorney reviewed web sources of information on Achieve, bank statements and source material provided by Achieve vendors, including FirstBank and Payoneer. He filed a 28-page declaration in advance of the asset freeze. This document distilled key pieces of evidence from Achieve sales pitches and financial records, calculating that investors had directed at least $3.829 million to Achieve and that Johnson and Barnes had taken “a minimum” of $336,975 “of investor funds.” (That’s roughly 9 percent, a circumstance that suggests Achieve’s Ponzi was digging a deeper and deeper hole.)

4. Two other SEC attorneys assigned to the Denver office. These attorneys brought the 17-page complaint against Achieve that alleged Achieve had “no legitimate business operations” and that “the sole source of repayments to earlier investors is funds contributed by newer investors.” (Though not referenced on the court docket of the Achieve case, the SEC, in a Feb. 18 public statement, confirmed a fourth agency attorney is involved in the probe.)

5. An SEC staff accountant employed by the Division of Enforcement and assigned to the Denver office. This person has been with the SEC for 20 years and examined and summarized records from at least five Achieve-related bank accounts, including “underlying detail” such as account-opening forms, statements, checks, wire transfers and deposit slips. (No criminal wrongdoing has been alleged and it is unclear if a criminal investigation is under way, but this information shows that the SEC, in part, halted Achieve the same way Internal Revenue halted Al Capone: with an accountant’s skill and experience in understanding numbers and tracking money flow. The same SEC accountant was involved in the memorable prosecution of recidivist con man Larry Michael Parrish, accused in 2011 of going to a Colorado hospital room to swindle a man dying of cancer.)

6. An SEC financial economist who holds a Ph.D in economics from the Massachusetts Institute of Technology. (This individual also studied in Chile and the Dominican Republic. She is a native speaker of Spanish, is fluent in English and also understands French. Based on her CV, I wouldn’t describe her as a secret weapon. But I do note that her international experience in areas that know poverty is a bonus, given that so many HYIP/Ponzi-board scams are targeted at people of limited means or people desperate for a positive economic result. Her MIT dissertation was titled, “Essays on Entrepreneurship” and was based in part on “survey data on the portfolios of U.S. families to study the tightness of borrowing constraints for entrepreneurs.” This may be important in context, because some Achievers already are making the absurd claim the SEC stands in opposition to entrepreneurship. One Achiever has claimed the agency’s Achieve action was a “systemic destroy tactic.” The same person has suggested the 9/11 terrorist attacks were a “false flag set up,” repeating a conspiracy theory that bizarrely accompanies just about any action that U.S. government takes against an HYIP scheme.)

Friends, Ponzi schemes are fraud per se — that is, they exist for no other reason than to commit fraud by theft. In the Internet Age in the network-marketing sphere, they have become organized schemes to defraud that are capable of involving thousands, hundreds of thousands or even millions of people. There is no such thing as a benevolent Ponzi scheme or a Ponzi scheme with “good intentions.”

Creating legions of victim-investors is only part of the problem.

The SEC’s supporting documentation suggests Achieve itself polluted the commerce stream at at least nine points of contact: three banks, one credit union, four payment processors and one brokerage firm. This number does not take into account the fact that some Achieve participants were issued debit cards onto which their “earnings” were loaded, thus putting any number of financial institutions in the position of becoming either dispensaries or warehouses for fraud proceeds.

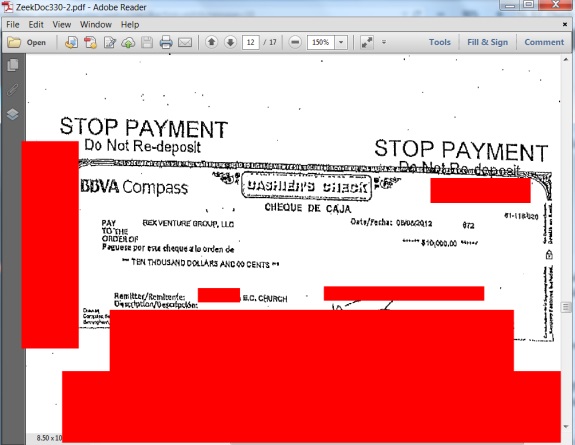

At least one Achieve promoter recorded a video of himself offloading Achieve money at an ATM in Hawaii. The SEC says bank records indicate Johnson gave $10,000 to a church, a circumstance that suggests the church came into possession of tainted funds.

Prior to filing the Achieve action, the SEC says in supporting filings, the agency did not contact “any” Achieve investors. Nor did it subpoena Achieve for information or personally view information in the private areas of Achieve’s websites.

Why not?

Because there was a “need to not alert Defendants of the investigation,” the SEC said in supporting materials. Beyond that, the agency said, “if investors were alerted to the SEC’s investigation, they would quickly disseminate that information to other TAC investors, as well as Defendants, which could risk additional dissipation or misappropriation of investor funds.”

An Outtake From The Paralegal’s Transcription

The next section of the PP Blog’s Special Report seeks to anticipate and then answer questions Achieve members may have. The answers are gleaned from supporting documents the SEC provided a federal judge as part of the process of bringing the Achieve complaint and seeking an emergency asset freeze. This section includes some commentary/analysis by the PP Blog.

Q: When did the SEC open its investigation into Achieve?

A: At least by January 2015. The specific date is unclear.

Q: Did the SEC receive tips about the operations of Achieve?

A: Yes. The number of tips and the identities of persons who provided them are not disclosed.

Q: Prior to the Feb. 12 asset freeze, did Achieve know it was under investigation by the SEC?

A: The agency said it did not advise Achieve of the probe. However, Kristi Johnson knew at least by Jan. 13 that the Colorado Division of Securities, the state-level regulator, was asking questions about Achieve, according to the SEC. On that date, the Division learned in an “interview” with Johnson that Achieve did its banking at FirstBank. The Division shared this information with the SEC. By Feb. 2, the SEC had obtained Achieve’s banking records. The SEC accountant then began to examine the records, sharing information with the SEC attorney/investigator.

Moreover, the SEC has alleged Johnson is a former “registered representative.” With experience in the securities industry and with Achieve already under investigation by a state regulator, Johnson must have contemplated that the SEC was hot on the Achieve trail. The SEC alleges she lives in Aurora, Colo. That’s only about 25 minutes away from the agency’s regional headquarters in Denver. It goes without saying that the SEC is particularly unfriendly to Ponzi schemes, perhaps particularly ones operating in its own back yard.

Q: Why the asset freeze?

A: Direct quote from SEC filings: “In light of the egregiousness of Defendants’ conduct, the ongoing and active Ponzi scheme, Defendants’ increasingly desperate attempts to make Ponzi payments and misappropriate investor funds, and the concern that Defendants will dissipate or misappropriate the remaining investor funds if they become aware of this action prior to the entry of the requested order, the Commission respectfully requests that the Court grant ex parte relief freezing the assets of Defendants and Relief Defendant, prohibiting them from soliciting additional investors or otherwise continuing their fraudulent scheme, and ordering other relief to ensure a prompt, fulsome, and fair hearing on Plaintiff’s motion for a preliminary injunction.

“Absent an order granting such emergency ex parte relief, there is no reason to think Defendants’ fraudulent scheme, and their misappropriation and dissipation of the remaining investor funds, will cease, or that there will be any funds available to compensate investor victims at the conclusion of this litigation.”

Q: What did the SEC accountant discover?

A: Plenty, including banking records pertaining to this Achieve International LLC check for $90,000 made  payable to “Cash” on Jan. 8, 2015. (Note: The check is dated Jan. 8, 2014, but that’s a new-year mistake. The banking records themselves note the correct date. The black redactions appear in a pdf of an SEC evidence exhibit. The PP Blog added the red redaction in this screen shot from the pdf. The $90,000 allegedly ended up in Kristi Johnson’s personal account at the Credit Union of Colorado.)

payable to “Cash” on Jan. 8, 2015. (Note: The check is dated Jan. 8, 2014, but that’s a new-year mistake. The banking records themselves note the correct date. The black redactions appear in a pdf of an SEC evidence exhibit. The PP Blog added the red redaction in this screen shot from the pdf. The $90,000 allegedly ended up in Kristi Johnson’s personal account at the Credit Union of Colorado.)

An SEC attorney/investigator who reviewed the accountant’s work across multiple Achieve-related bank accounts alleged in a declaration to the court that the “bank records indicate that on at least thirteen occasions, Johnson went to a FirstBank branch and withdrew cash in the form of currency, or cash in the form of a check written to ‘cash.’ Virtually all of thee funds ended up in an account at the Credit Union of Colorado . . . that is Johnson’s personal account.” Such transactions involved $153,300.

Q: Will I get my money back or a percentage of it from Achieve?

A: Possibly. How that would occur is unclear. No receiver has been appointed. The SEC investigation is ongoing.

Q: Will Achieve “winners” be treated like Zeek Rewards “winners” — i.e., sued for return of the funds?

A: Too soon to tell. The SEC investigation is ongoing. An ongoing investigation sometimes means an amended complaint or additional complaints will be filed that names additional defendants or “relief defendants” — those in alleged possession of ill-gotten gains.

Q: I’ve read online that the best practice with these programs is to throw in my stake with affiliates promoting them on YouTube and Facebook. These purported experts also say not to risk more than I can afford to lose and to quickly remove my “seed money” to create a situation that I’m only playing with “house money” — “profits” from the scheme. What am I to believe?

A: Believe the SEC and FINRA. They have been warning about fraud schemes that use social media for years. The receiver in the Zeek Rewards case has raised concerns that “serial” promoters are moving from one fraud scheme to another. At least four promoters of the TelexFree scheme have been charged with securities fraud by the SEC.

NOTE: Our thanks to “NikSam” at RealScam.com and to the ASD Updates Blog.