URGENT >> BULLETIN >> MOVING: (17th update 3:07 p.m. ET U.S.A.) The U.S. Securities and Exchange Commission has charged “Achieve Community” (as Work With Troy Barnes Inc.) and alleged operators Troy A. Barnes and Kristine L. Johnson with operating a combined pyramid- and Ponzi scheme that raised more than $3.8 million. A federal judge in Colorado has ordered an asset freeze and granted a temporary restraining order.

URGENT >> BULLETIN >> MOVING: (17th update 3:07 p.m. ET U.S.A.) The U.S. Securities and Exchange Commission has charged “Achieve Community” (as Work With Troy Barnes Inc.) and alleged operators Troy A. Barnes and Kristine L. Johnson with operating a combined pyramid- and Ponzi scheme that raised more than $3.8 million. A federal judge in Colorado has ordered an asset freeze and granted a temporary restraining order.

“Johnson and Barnes allegedly claim to be operating a successful investment program when in fact they are taking funds from new investors to pay phony profits to earlier investors,” said Julie Lutz, director of the SEC’s Denver Regional Office.

Achieve’s internal structure is part of the probe.

“Johnson is one of the two founders of TAC, and handles the majority of TAC’s finances,” the SEC charged. “Johnson is an authorized agent of WWTB and has acted as the sole signatory on at least three bank accounts that she opened in the name of WWTB.”

Meanwhile, the Colorado Division of Securities confirmed minutes ago that it was working with the SEC on the Achieve probe.

“We continue to have our own open investigation regarding possible violations of the Colorado Securities Act,” said Lillian Alves, Colorado’s Deputy Securities Commissioner. “The factual basis of our investigation parallels that of the SEC case.”

In a 17-page complaint that was filed under seal on Feb. 12, the SEC described the Achieve Community as a “pure Ponzi and pyramid scheme” whose revenue “has consisted entirely of investor-contributed funds.”

“Johnson and Barnes have made no effort to generate profits from any legitimate business operations from which they could repay earlier investors,” the SEC charged. “Instead, the sole source of repayments to earlier investors is funds contributed by newer investors.”

The Feb. 12 filing date likely means that Achieve still was trying to raise money even as the SEC was in court to request an emergency asset freeze. On Feb. 12, a Barnes-narrated video appeared on YouTube. The 11:06 video was titled “Thursday Update 2 12.” The video provided Achieve members instructions on how to register for a purported new payment processor.

By Feb. 14, Achieve members were quoting a forum post attributed to Barnes that Achieve’s assets had been frozen. Whether a criminal probe is under way is unclear.

Barnes is 52. He resides in Riverview, Mich., according to the complaint. Johnson, known as “Kristi,” is 60. She resides in Aurora, Colo.

Johnson also is associated with an entity known as “Achieve International LLC,” which has been named a relief defendant as an alleged recipient of funds from the fraud.

“Johnson formed Achieve International as a Colorado entity, is an authorized agent of Achieve International, and, on information and belief, is the sole member, and managing member, of Achieve International,” the SEC said. “Johnson has acted as the sole signatory on at least one bank account that she opened in the name of Achieve International. Johnson is a former registered representative, and was last associated with a registered entity in 1996.”

Some Achieve members have described Johnson as a “former stockbroker.” The SEC’s allegation that she is a former registered representative may be particularly problematic for her, leading to troubling questions about whether she simply ignored the very real possibility that the SEC would do exactly what it did: charge her with securities fraud and allege she and Barnes made “material misrepresentations and omissions” about the nature of Achieve.

The SEC accuses both Johnson and Barnes of misappropriating funds sent in by Achieve investors.

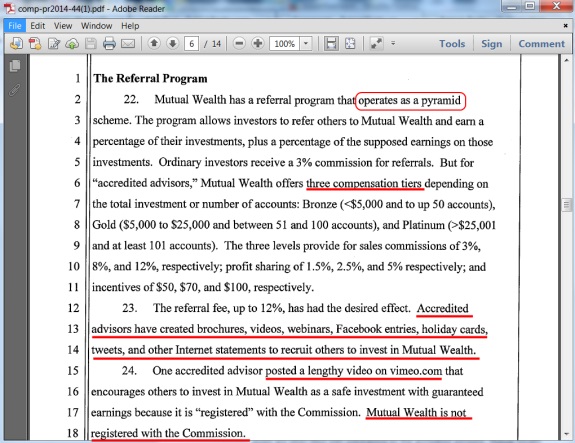

From the complaint (italics added/light editing performed):

In addition to making Ponzi payments to investors, Defendants have misappropriated investor funds for Johnson and Barnes’ own personal use.

On more than a dozen occasions, Johnson made significant cash withdrawals or wrote checks to “Cash” from the WWTB and Achieve International accounts, and made corresponding cash payments to her personal accounts.

Johnson used these investor funds to pay her personal expenses, including paying nearly $35,000 in cash for a new car, and making personal credit card payments.

To date, Johnson has misappropriated at least $150,000 in investor funds.

Similarly, Barnes has misappropriated investor funds. Using thirteen separate transfers reflected on WWTB bank statements as “Visa Paypal *Troy Barnes,” Johnson transferred approximately $40,000 to Barnes.

The seal on the complaint was lifted yesterday afternoon in Colorado federal court. Achieve’s websites went offline yesterday. Whether the outage was related to the TRO was not immediately clear.

What is clear is that the SEC wasn’t impressed by Achieve’s claims that a “triple algorithm” somehow made a 700-percent ROI possible. It’s also clear that the SEC spent plenty of time listening to and transcribing recordings used to sell the scheme.

Johnson said this in a conference-call pitch, the SEC alleged: “I thought, what can I do, what can I make, what can I design, that has only what works and none of what doesn’t, and one day, honestly this is what happened, I just saw it. I just saw it in my head. This matrix is 3D, which is why we can’t put it on paper. It’s a triple algorithm. And I can’t for the life of me tell you why I could figure that out in my head. But I could.”

Barnes claimed he hired a programmer “who spent three months perfecting the ‘triple algorithm’ investment formula,” the SEC said.

The trouble, the agency said, was that Achieve had “no legitimate business operations; the only available funds to pay the promised investment returns come from new investors lured into the scheme.”

With their “triple algorithm” cover story, Johnson and Barnes went on to fleece Achieve members, the SEC said.

“In a short video on TAC’s website, again narrated by Johnson, Johnson encourages investors to repurchase new ‘positions’ with their investment returns rather than taking money out of TAC,” the SEC alleged. “Johnson explains that by purchasing one $50 ‘position,’ and then using the $400 investment return to repurchase 8 positions, the investor would earn $3,200. Johnson goes on to explain that, if the investor used the repurchase strategy again, she would then have 64 positions worth more than $25,000. Johnson states that this strategy will ‘give you the same income over and over again, forever.’”

She was hardly alone, the SEC charged.

“Barnes makes similar statements about TAC’s ‘Re-Purchase’ strategy,” the agency alleged. “For example, in a video posted online touting TAC, Barnes states that investors can repurchase more ‘positions’ to make more money. In another online video, Barnes claims that, with the ‘Re-Purchase’ strategy, it is ‘very easy to make six figures.’”

The SEC said its investigation was ongoing. Johnson is the only person alleged in the Feb. 12 complaint to have hauled $100,000 or more out of Achieve.

Johnson and Barnes are charged with securities fraud. And despite claims online that Achieve wasn’t selling an investment or a security and therefore the SEC would have little or nothing to say on the matter, the filing of the complaint shows those claims were a crock.

Achieve’s “positions” are “securities under federal law,” the agency charged.

U.S. District Judge Robert E. Blackburn granted the TRO and asset freeze.

The SEC is seeking an order “that each of the Defendants and the Relief Defendant disgorge any and all ill-gotten gains, together with pre-judgment and post-judgment interest, derived from the activities set forth in this Complaint.”

At the same time, the agency is seeking “civil money penalties.”

Achieve had a presence on well-known Ponzi-scheme forums such as MoneyMakerGroup and TalkGold. Some Achieve promoters created YouTube videos and have moved to other Ponzi-board scams.

Here is a link to the SEC’s statement on Achieve and complaint. The agency also posted a Twitter link (below).

News release: SEC halts Colorado-based #pyramidscheme: http://t.co/U2yfWQPShY

— SEC_News (@SEC_News) February 18, 2015