“No!” Make that “Hell no!” — or, as Gen. Anthony McAuliffe once famously scribbled at the prompting of Gen. Harry W.O. Kinnard during the Battle of the Bulge, after soldiers for the Nazi Third Reich demanded surrender: “Nuts!”

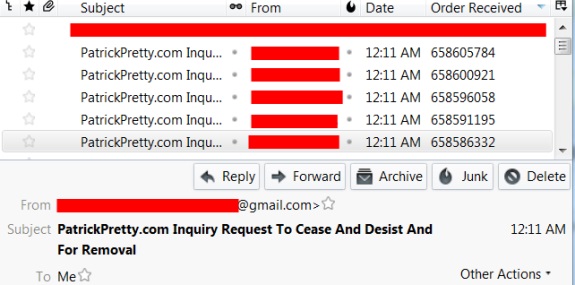

At 12:11 a.m. ET today, the PP Blog inexplicably received five duplicate emails from an IP in the vicinity of Tiffin, a city in North Central Ohio. The emails were sent through the Blog’s contact form and threatened that “the authorities” would get involved if the Blog did not remove content about Nanci Jo Frazer and other Profitable Sunrise story figures by Nov. 15, nine days from today. The emails were signed “Nanci Jo Frazer,” but the Blog cannot independently confirm Frazer was the sender.

Why the Blog received five emails is unknown. The Blog tested the form after receiving the duplicated submissions, and it appears to be working properly, meaning it does not appear to be sending multiple copies of inquiries from readers. The Blog, however, did experience an outage that lasted approximately two hours yesterday. The outage occurred shortly after an IP from Ukraine made an appearance here at approximately 1:50 p.m. (Bots that leave a Ukranian signature have been circling the Blog for weeks.) The precise cause of yesterday’s outage, which occurred after the Blog reported on an HYIP/prime-bank scam in California outed as part of an FBI undercover operation that began in 2006, remains unclear.

In any event, the Blog will not remove any Frazer or Profitable Sunrise-related content unless ordered to do so by a U.S. federal judge. Nor will it submit to threats that incongruously are mixed with appeals to the Christian faith to make posts go missing. HYIP schemes are all about incongruities and preposterous constructions: “secret” or “safe” or “guaranteed” or “insured” investments that purportedly are “offshore” and able to deliver Christians and other people of faith legitimate interest rates of hundreds or even thousands of percent each year, for instance.

For security reasons, the Blog will not reply to the emails at the Gmail address entered by the sender. Instead, it will publish the content of the emails in this space. The FBI is free to make its own assessment about acts attributed to the agency by the sender in or around Tiffin. The Blog also will continue to publish Profitable Sunrise-related stories. Such stories are in the public interest.

The emails build on a conspiracy theory that has been circulating for weeks: that the Blog somehow acts in concert with fraudsters, cyberstalkers and at least one felon posing as a Christian do-gooder to subject Nancy Jo Frazer and her ministry to harm. Meanwhile, the emails plant the equally false seed that the Blog is part of a group involved in Bitcoin scams.

Among other things, the emails seek to chill the Blog’s reporting by contending that “The FBI is fully aware of all your consistent attempts to keep my name and our FocusUp Ministries Board members, our staff, voluteers and even my husband (who had no connection) tagged to negative , damaging words (such as scam, fraud and Ponzi) along with negative press and stories we are not connected to at all.” (No editing performed by PP Blog.)

“Last week through a phone conversation, the Senior investigator from the FBI, instructed me to have my attorney send you a Cease and Desist and demand for immediate removal of your unauthorized usage of materials, videos, audio, all radio & TV media, articles and all types of communication connected to FocusUp Ministries and our Board Members, staff and volunteers: including Nanci Jo Frazer (Nancy Frazer) and Albert Rosebrock, David Steckel (volunteer), Jon Simmons (staff pastor) also my husband David Frazer,” the emails read in part. (No editing performed by PP Blog.)

The emails did not identify the purported “Senior investigator from the FBI” who purportedly gave the sender instructions on how to accomplish the deletion of PP Blog content the apparent Frazer group supporter finds both objectionable and actionable. The PP Blog is willing, however, to voluntarily provide the IP address of the sender to the FBI, the SEC, the Ohio Office of the Attorney General or other law-enforcement agency in the United States that has an interest in the Profitable Sunrise case.

No subpoena will be necessary; we’ll simply provide the information and copies of the email, once the Blog verifies the request is genuine.

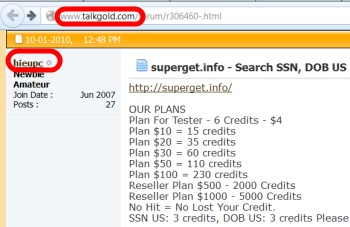

Over the years, the PP Blog has encountered various bids to chill its reporting on the HYIP sphere, including a sustained DDoS attack in 2010 and traffic floods in 2011 for which the Blog received a claim of responsibility. The Blog forwarded the claim to a U.S. law-enforcement agency.

In 2012, during a period of heavy reporting on two specific HYIP schemes, the Blog received repeated threats believed to be from different senders. Two of the threats were not aimed at the Blog. The first was received Aug. 6, 2012, and was aimed at three prominent U.S. politicians: one Democrat and two Republicans. This communication appeared to have been sent from Switzerland and questioned why the American politicians are “still alive and running around.” The email further described an American subject of the PP Blog’s crime reporting as a “true Patriot[]” who, like other purported “Patriots,” believed in “sending out mercenaries to take out those corrupt bankers, USG politicians, agents, judges and attorney’s [sic].”

Such content is consistent with members of the so-called Patriot Movement or similar U.S. extremists who identify themselves as “sovereign citizens.” Because the communication appears to have originated in a country famous for banking secrecy, it leads to questions about whether U.S. domestic extremists were networking with counterparts in Europe or perhaps were there themselves to “defend” HYIP schemes and chill reporting on the outrageous frauds by suggesting that mercenaries and assassins were at their disposal.

The second communication, received Aug. 29, 2012, was aimed at the alleged operator of a huge international Ponzi scheme. This communication appears to blame the accused operator for not properly defending the purported opportunity from investigations by the U.S. government.

“why you don’t stand to back [program name deleted by PP Blog][?]” the communication read in part.

“we lost our money. we will kill you . . .”

The communication concluded by slurring the alleged Ponzi operator as a “dog.” It appears to have been sent from Pakistan.

Yet-another 2012 communication believed to be from a different sender suggested that members of the PP Blog’s family might die if the Blog continued to report on HYIP schemes. The Blog forwarded all of these communications to a U.S. law-enforcement agency.

In 2009, the Blog repeatedly was stalked by an apologist for the AdSurfDaily and AdViewGlobal Ponzi schemes who sought to engineer an SEO campaign against the Blog. This tactic was repeated in 2012 by an apologist for the JSSTripler/JustBeenPaid scheme which, like ASD and AVG, may have ties to the “sovereign citizens” movement.

This specific individual appears to have been inspired in part by an infamous troll whose posts and visits bear an IP signature from the United Kingdom. The troll has been attacking antiscam sites since at least 2009, often incorporating sexual innuendo, antiChristian themes and elements of misogyny into his bizarre and vulgar game plan. In any event, the JSS/JBP apologist he inspired asserted he’d defend purported operator Frederick Mann “so help me God.” He also targeted specific PP Blog readers in an SEO campaign carried out on a free Blogger site — all while spreading absurd conspiracy theories and utterly preposterous lies. At the same time, he appears to have embedded code in certain communications as a means of trying to identify potential federal witnesses and perhaps even obtain/isolate the identities undercover federal agents may use online.

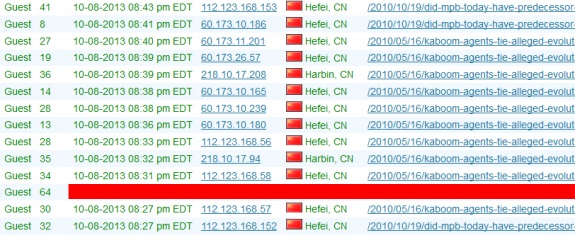

Requests for the Blog to delete content are not always menacing, but can be described fairly as mind-bogglingly bizarre. In 2010, an affiliate of the MPB Today MLM scheme asked the Blog to delete a story that reported President Obama and former Secretary of State Hillary Rodham Clinton were being depicted as Nazis in a promo designed to recruit MPB Today affiliates. A separate script from the same MPB Today recruiter described the Obama family as welfare recipients who aspired to eat dog food and put these words into the mouth of First Lady Michelle Obama: “Hmm, I should prolly call my Food Stamp worker now that I’ve joined MPB.”

The Blog declined the deletion request.

MPB Today operator Gary Calhoun later was jailed in Florida on state-level racketeering charges. Federal prosecutors contended in July 2012 that crimes such as access-device fraud and fraud in connection with identification documents had occurred. Some MPB Today affiliates claimed the purported grocery “program” had been endorsed by the U.S. government and Walmart and that impoverished prospects should sell their Food Stamps to raise the $200 needed to join MPB Today. At least one MPB Today affiliate referenced pipe bombs in a promo.

In May 2009, the PP Blog reported that the AdViewGlobal scam announced it had secured a deal with a new offshore wire facilitator. The AVG announcement was made on the same day the President of the United States announced a crackdown on offshore fraud. The PP Blog later was asked by AVG’s purported facilitator to remove the story. The Blog refused.

The purported AVG facilitator — KINGZ Capital Management Corp. — later was linked to the epic Trevor Cook Ponzi scheme in Minnesota and was booted from the National Futures Association. AVG earlier had collapsed in a pile of Ponzi rubble. Even as it was going down, critics of the “program” and even members concerned about where their money had gone were threatened with lawsuits and ISP terminations for speaking out online.

Federal prosecutors later linked the AVG scam to the $119 million AdSurfDaily Ponzi scheme broken up by the U.S. Secret Service in 2008. ASD story figure Kenneth Wayne Leaming, a purported “sovereign citizen,” is serving a federal prison sentence for targeting federal employees involved in the ASD case with bogus liens seeking billions of dollars, assisting a known tax fraudster in the filing of false liens, harboring federal fugitives in a case unrelated to ASD and being a felon in possession of firearms.

HYIP schemes are a cancer on America and the rest of the globe because they permit the murkiest of figures to acquire tremendous sums of money that endanger the United States and other nations. They are a scourge on society in no small measure because they attract “sovereign citizens” and other extremists whose intent is to undermine legitimate markets and create widespread confusion, if not anarchy. People of faith often are targets of HYIP scammers. The scams often switch forms, but the criminality remains largely the same.

In the case of Profitable Sunrise, the SEC has alleged that potentially tens of millions of dollars were driven to an individual potentially operating overseas. This individual’s identity may not be known. The allegations alone are chilling.

Frazer and her associates are not named in the SEC civil action. But Frazer and two of her alleged business associates — husband David Frazer and Nancy Frazer business associate Albert Rosebrock — are named in a Profitable Sunrise-related civil fraud action filed by the state of Ohio in July.

As noted above, the PP Blog will not remove any Frazer or Profitable Sunrise-related content. Here, now, the verbatim content of the emails received by the Blog at 12:11 a.m. today. (The Blog added carriage returns to make the contents more readable.)

The Emails

Dear Patrick;

I am send you this private (not to be published or shared) email to you as a Christian brother, from your Christian sister, in hopes to have your assistance to stop all media coverage concerning our Ministry and our volunteer board members without having to get the authorities involved to get this accomplished.

We understand that you have been trying to find the truth about Profitable Sunrise. The FBI has fully reviewed every document, communication and record we have and has returned everything to us. Our lead investigator stated that it is clear that we were a victim of “innocent ignorance”.

The investigation resulted in no criminal charges being filed. The Federal Government has confirmed we are not being named in this case. Kansas is in the process of dismissing the case and Ohio has stated they do not have enough information to move forward (after losing the majority of the assets at our hearing on August 30th, 2013). We are so thankful that we are finally being vindicated and can speak out soon.

2013 has been a refining year but so many awesome miracles have occurred that I cannot just feel there was no positive purpose. We believed that Profitable Sunrise was the “real deal”. We know that many of you believe that BitCoin is the “real deal” but in Texas, it is now declared a security and to some- part of a Ponzi? We sometimes learn things the hard way.

The FBI is fully aware of all your consistent attempts to keep my name and our FocusUp Ministries Board members, our staff, voluteers and even my husband (who had no connection) tagged to negative , damaging words (such as scam, fraud and Ponzi) along with negative press and stories we are not connected to at all. Thus driving traffic to your website for your own purpose.

Last week through a phone conversation, the Senior investigator from the FBI, instructed me to have my attorney send you a Cease and Desist and demand for immediate removal of your unauthorized usage of materials, videos, audio, all radio & TV media, articles and all types of communication connected to FocusUp Ministries and our Board Members, staff and volunteers: including Nanci Jo Frazer (Nancy Frazer) and Albert Rosebrock, David Steckel (volunteer), Jon Simmons (staff pastor) also my husband David Frazer.

I am requesting that Patrickpretty.com and all associate websites, blogs and media… Cease and Desist immediately from using images, text, tags,YouTubes, Powerpoints, articles, documents and recordings associated in any way with the patrickpretty.com website, which is containing or referring to Nanci Jo Frazer, Nancy Frazer, David Frazer, Albert Rosebrock, David Steckel, Jon Simmons and FocusUp Ministries and/or any of our associate Ministries, as you are not authorized to use our names or image for any purpose without written permission.

We have spent hundreds of hours of research to help authorities in everyway to fully understand and solve this case. We are almost to the point whereas I can share what I have learned to help avoid this event from happening again. I believe in going to my Christian brother first to resolve an issue. I believe that your heart is in the right place.

We need to see that everything is deleted and completely removed from the Internet by Friday, November 15th, 2013 so we can all move on. I hope you honor this and that we can start over and have this be a much better story for all.

Thanks Patrick!

Nanci Jo Frazer