Are “sovereign citizens” immersed in the “SVM Global Initiative” and “UFunClub” cross-border, network-marketing schemes?

Are “sovereign citizens” immersed in the “SVM Global Initiative” and “UFunClub” cross-border, network-marketing schemes?

“Sovereign citizens” may have an irrational belief that laws do not apply to them. It is not unusual for them to be involved in financial fraud, and some “sovereigns” have been linked to MLM HYIP frauds and securities offering frauds.

Individuals who join such schemes may not understand they have signed on to enterprises engaging in international fraud and that a political agenda or even political extremism may be driving events.

In a conference call Tuesday night for SVM, a man who identified himself as “Nelson” calling from “Saskatchewan, Canada” came on the line. He explained that he’d been with SVM “from the very beginning” and was involved in “world-shaking affairs, including the global currency reset.”

Precisely what constituted the purported “reset” wasn’t explained, but the term has been associated with banking conspiracy theorists and “sovereign citizens.” AdSurfDaily Ponzi story figure Kenneth Wayne Leaming, for instance, allegedly claimed “the Rothschilds” were hiding in a “bunker in India” while controlling the central bank of Iraq, according to a 2011 complaint against Leaming that accused him of filing bogus liens against public officials and other crimes.

The complaint was filed by a member of an FBI Terrorism Task Force operating in Washington state. Leaming, who’d been under federal surveillance, later was convicted on charges of filing false liens, harboring two federal fugitives wanted in a separate home-business caper in Arkansas and being a felon in possession of firearms.

Banking conditions in Iraq were causing the Rothschilds to lose money, and the “inner circle” is “jumping ship,” Leaming allegedly told a colleague, “just like body odor’s inner circle in the White House.”

“Body odor” was a veiled reference to President Obama. ASD was a “program” that claimed a daily payout rate of 1 percent. The $119 million scheme spread over the Internet, creating thousands of victims. ASD was broken up by the U.S. Secret Service in 2008.

A Troubling Narrative: Was A Rallying Cry Of ‘Sovereign Citizens’ Part Of It?

On the call hosted by SVM’s Sheila V. Tabarsi, “Nelson” further ventured that he had “many connections in the international banking arena.

“I have many connections in law; I have many connections in military — on and on and on,” he said.

During his fawning over SVM, “Nelson” went on to make a veiled reference to UFunClub, now the subject of a major investigation in Thailand. This leads to questions about whether he is involved in two separate cross-border schemes and whether other SVM members also are pushing multiple schemes.

“Nelson” said this before he got off the line (italics added):

“And God Bless the Republic of the United States of America.”

It is a term often associated with “sovereign citizens” and, in written form, may be abbreviated and stylized RuSA. The term is closely associated with James Timothy “Tim” Turner, who was sentenced to federal prison in 2013 for his role in a bizarre tax scam. (Also see Quatloos thread on RuSA.)

BehindMLM.com’s Review Of SVM

Here we’ll point you to BehindMLM.com’s April 13 review of SVM. We’ll note that the Tuesday SVM call more or less was an effort to slime the online publication, which reports on emerging MLM schemes.

SVM appears to operate out of Greater New York City, perhaps from the Bronx and Manhattan — with an arm in Costa Rica.

Prior to “Nelson” coming on the line, Tabarsi asserted BehindMLM.com was a “pawn” and a “coward” that works with an unidentified third party to “bring network-marketing companies down.”

“To me, this is real Illuminati kind of stuff,” Tabarsi said. “Granted, the success of Sheila V and Associates and the SVM Global Initiative could do some devastating things to the network-marketing industry.”

Other MLM schemes have trotted out the theme that dark forces — usually cast as competitors unhappy that downlines are leaving one “program” because another has found the Holy Grail — are controlling things behind the scenes or secretly. It is not unusual for political rhetoric, conspiracy theories or antigovernment sentiment to become part of the narrative, and this may be happening with SVM.

Other MLM schemes have trotted out the theme that dark forces — usually cast as competitors unhappy that downlines are leaving one “program” because another has found the Holy Grail — are controlling things behind the scenes or secretly. It is not unusual for political rhetoric, conspiracy theories or antigovernment sentiment to become part of the narrative, and this may be happening with SVM.

Tabarsi, for example, said during Tuesday’s call that the “Bush administration” was involved in an “effort to dismantle this world economy” and that the effort has been “so concentrated” and “so diligent.”

The aim, she contended, was to concentrate 99 percent of the world’s wealth in the hands of 1 percent of the people.

“We are a threat to that,” she said. “The success of Sheila V and Associates and the SVM Global Initiative is a threat to this establishment that is trying so long and so hard to take everybody down.”

Any number of MLM schemes have advanced forms of this narrative. The $1.8 billion TelexFree scheme broken up by the SEC last year was positioned as a “revolution” that would put wealth in the hands of ordinary people. Though much smaller in scale, the Achieve Community scheme broken up by the SEC earlier this year advanced a similar narrative.

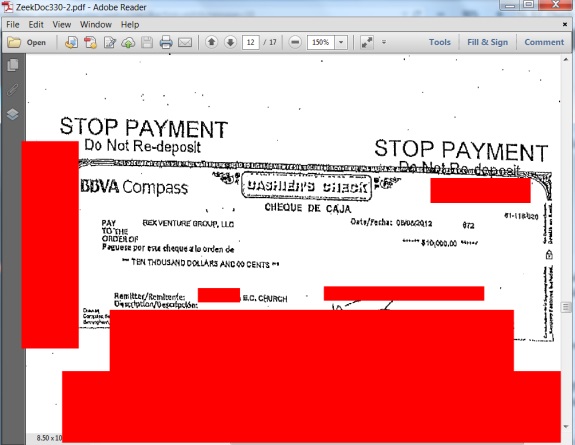

TelexFree and Achieve — like the Zeek Rewards scheme in 2012 — were operating combined Ponzi- and pyramid schemes, the SEC has alleged.

SVM, through Tabarsi, has positioned itself a network-marketing enterprise with three arms. Working together, these three arms — Sheila V. and Associates LLC (New York), The Marketplace at SV&A LLC (Costa Rica) and SVM Redesign Your Life America with an organ called “The Freedom Fund” — purportedly will elevate people out of poverty.

On her website, Tabarsi says she is a “4th Generation Native Cherokee/African American Spiritual Life Coach, Universal Life Church Minister, Business and Medical Intuitive with 17 active years of practice performing Clair-empathic healings and various forms of intuitive readings.”

She also notes she is a “corporate administrative manager, former U.S. Air Force Staff Sergeant and Veteran of the ’91 Gulf War” who established “SVM ReDesign Your Life America, a non-profit organization to convert abandoned military bases into places to end poverty and homelessness.”

In a March conference call, she claimed she was under investigation by a U.S. Attorney’s office and the FBI, among others. She denies she has done anything wrong.

“The FBI is involved only because I have international clients, but not that there’s too much they can really act on,” she said during the call last month.

Because SVM says it has a presence in the Bronx and Manhattan, the PP Blog on Wednesday contacted the office of U.S. Attorney Preet Bharara of the Southern District of New York for comment on SVM, UFunClub and “Nelson’s” line about the “Republic of the United States of America” during the Tuesday SVM call.

The office has not responded to the request.

NOTE: Also see the MLM Skeptic Blog: “Is a Scam Targeting Veterans ‘to end poverty’ citing a FAKE JAG lawyer?”

BULLETIN: (6th Update 8:34 p.m. EDT U.S.A.) Zeek Rewards’ receiver Kenneth D. Bell has gone to federal court in the Western District of North Carolina, seeking default judgments against key clawback defendants and alleged “winners” Trudy Gilmond and Jerry Napier, a figure in the AdSurfDaily Ponzi-scheme story.

BULLETIN: (6th Update 8:34 p.m. EDT U.S.A.) Zeek Rewards’ receiver Kenneth D. Bell has gone to federal court in the Western District of North Carolina, seeking default judgments against key clawback defendants and alleged “winners” Trudy Gilmond and Jerry Napier, a figure in the AdSurfDaily Ponzi-scheme story.