EDITOR’S NOTE: KrebsOnSecurity is written by Brian Krebs, who worked as a reporter for the Washington Post from 1995 to 2009. Our thanks to a PP Blog reader who brought our attention to information highlighted in the story below. Although the PP Blog is focusing on the TalkGold angle, the KrebsOnSecurity report covers much more, including how a U.S. credit-reporting agency potentially was doing business with a credit-card scammer and forum huckster hiding behind a proxy and wiring money from Singapore. It is highly recommended reading. Two links to the report appear in the story below.

An individual who used the handle “hieupc” on the “scammer-friendly” TalkGold forum may have peddled stolen Social Security numbers at the forum and appears also to have been in the business of defacing websites and “even attacking the Web site of his former university in New Zealand after the school kicked him out for alleged credit card fraud,” KrebsOnSecurity reports.

Hieu Minh Ngo, 24, a Vietnamese national, now is jailed in the United States. He was charged in a sealed, 15-count indictment in November 2012 with conspiracy to commit wire fraud, substantive wire fraud, conspiracy to commit identity fraud, substantive identity fraud, aggravated identity theft, conspiracy to commit access device fraud, and substantive access device fraud, the U.S. Department of Justice said on Oct. 18.

It may be a case of an offshore fraudster who erroneously believed that U.S. agents and prosecutors couldn’t touch him and grew increasingly confident that oceans and land masses that separated him from the United States would insulate him from arrest. In its remarkable story, however, KrebsOnSecurity is reporting that U.S. federal agents “set up a phony business deal to lure Ngo out of Vietnam and into Guam, an unincorporated territory of the United States in the western Pacific Ocean.”

Ngo was arrested when he arrived in Guam, KrebsOnSecurity reports.

Citing the indictment, the Justice Department said, “[F]om 2007 through 2012, Ngo and other members of the conspiracy acquired, offered for sale, sold, and/or transferred to others packages of [Personally Identifiable Information] for more than 500,000 individuals.” (Bolding added by PP Blog.)

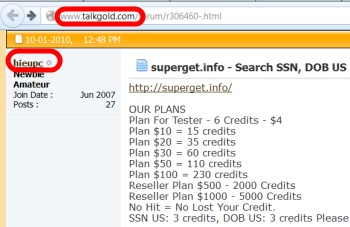

The User ID of “hieupc” appears to have been formed at TalkGold in June 2007. (See screen shot above.) In October 2010, a TalkGold post attributed to “hieupc” offered for sale the Social Security numbers and dates of birth (at least) of Americans.

If “hieupc” is Ngo, it could mean he was trawling TalkGold as a teen-ager and seeking to recruit HYIP scammers as customers for his identity-theft ring. Such an approach conceivably could enable fellow criminals to join HYIP scams under assumed names while providing them a means of accessing U.S. bank accounts, potentially setting the stage for them to steal money from the accounts and even pass tax liabilities for HYIP program “earnings” to unknowing victims. TalkGold is populated by serial HYIP fraudsters and willfully blind promoters of online fraud schemes. Over the years, such schemes have led to DDoS attacks on the sites of fraud schemes (and sites that report on them) and repeated claims of account hackings.

Here is part of the “hieupc” TalkGold pitch (italics added):

OUR PLANS

Plan For Tester – 6 Credits – $4

Plan $10 = 15 credits

Plan $20 = 35 credits

Plan $30 = 60 credits

Plan $50 = 110 credits

Plan $100 = 230 credits

Reseller Plan $500 – 2000 Credits

Reseller Plan $1000 – 5000 Credits

No Hit = No Lost Your Credit.

SSN US: 3 credits, DOB US: 3 credits Please register an account to buy credits. Thanks

Such packages of Personally Identifiable Information, the Justice Department said, are known as “fullz” and “typically included a person’s name, date of birth, social security number, bank account number and bank routing number.”

And Ngo had at least one co-conspirator, according to the now-unsealed grand-jury indictment filed in U.S. District Court for the District of New Hampshire. In the indictment, the co-conspirator is identified as “JOHN DOE ONE,” also known as “rr2518” and “Wan Bai.”

Here is the first paragraph from the indictment, which is available through a link at the KrebsOnSecurity website:

Defendant HIEU MINH NGO (“NGO”), also known by online monikers that include “hieupc” and “traztaz659,” resided in New Zealand and Vietnam. He is one of the control persons and administrators for the websites “findget.me” and “superget.info,” and its associated data.

During the 2007-2012 time period, “Ngo and other members of the conspiracy acquired, offered for sale, sold, and/or transferred to others stolen payment card data, which typically included the victim account holder’s payment card number, expiration date, card verification value number, account holder name, account holder address and phone number,” the Justice Department said in its Oct. 18 statement.

Meanwhile, the indictment notes that an “undercover agent located in New Hampshire” was involved in the probe that led to Ngo’s arrest and that the agent was instructed by scammers “to open an account with ‘Liberty Reserve’ in order to engage in any financial transactions with them.”

In May 2013, federal prosecutors in New York alleged that Liberty Reserve had engaged in a $6 billion money-laundering conspiracy. The U.S. Secret Service is known to be involved in both the Liberty Reserve and Ngo identity-theft probes. Liberty Reserve was popular among HYIP fraudsters and other scammers.

TalkGold is not referenced in the Ngo indictment. But the forum’s name appears in other court filings as a place from which online Ponzi and fraud schemes are promoted. Just five of the hundreds of recent (or relatively recent) scams promoted at the forum — Zeek Rewards, Profitable Sunrise, AdSurfDaily, PathwayToProsperity and Legisi — are believed to have generated receipts approaching or exceeding $1 billion. (Zeek Rewards = $600 million; ProfitableSunrise = unknown tens of millions; AdSurfDaily = $119 million; PathwayToProsperity = $70 million; Legisi = $72 million.)