Under the terms of his plea agreement, AdSurfDaily President Andy Bowdoin effectively has been banned from multilevel marketing, Internet opportunities and businesses that employ mass marketing.

Under the terms of his plea agreement, AdSurfDaily President Andy Bowdoin effectively has been banned from multilevel marketing, Internet opportunities and businesses that employ mass marketing.

The agreement contains this provision, and Bowdoin consented to it in writing as a condition of release before he is formally sentenced: “Your client shall not participate in any business venture using the internet, multi-level marketing, or mass marketing.” (Italics added.)

Language in the agreement suggests the bans could last until Bowdoin is well into his eighties — until Bowdoin, now 77, serves any prison or probationary term imposed. No sentencing date has been scheduled. Bowdoin’s next court date is set for June 12 “to determine if he should be incarcerated pending his sentencing,” federal prosecutors said.

Bowdoin pleaded guilty yesterday to wire fraud for the web-based ASD scam. The information in the numbered entries (below) was confirmed by Bowdoin himself in a “Statement of Offense” that bears his signature. It is in stark contrast to earlier online claims by the ASD patriarch that he had been railroaded and that ASD members should send him money to pay for his criminal defense.

Second Key Win For Government

Bowdoin’s guilty plea marked the second recent win by the government in a major online HYIP case. Gregory N. McKnight, the operator of the Legisi HYIP and Ponzi scheme, pleaded guilty to wire fraud in February. The Legisi and ASD schemes fetched a combined haul of more than $180 million, according to court filings. Bowdoin’s scheme was a form of HYIP fraud known as “autosurfing” in which participants were promised enormous returns for viewing advertisements. The schemes spread in part through social networking and shilling sites such as the TalkGold and MoneyMakerGroup forums.

The U.S. Secret Service was involved in both the ASD and Legisi probes.

ASD Discussed In HYIP’s Conference Call Day Before Bowdoin Guilty Plea

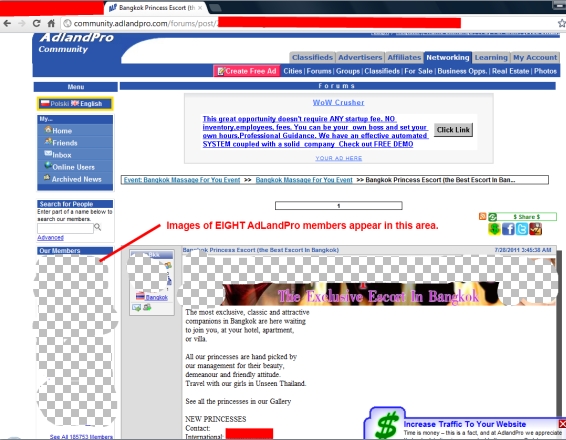

A current HYIP scheme known as JSS Tripler/JustBeenPaid continues to make inroads online. Frederick Mann, the purported operator of JSS/JBP, was identified in 2008 promos as an ASD pitchman. Bowdoin’s legal problems were among the subjects of a JSS/JBP conference call Thursday that appeared to be heavily populated by U.S. residents, including some who expressed worry about the “program.” JSS/JBP purports to provide a daily return of 2 percent, twice that of ASD.

Less than 24 hours after Thurday’s JSS/JBP call ended, Bowdoin pleaded guilty in open court and subjected himself to a possible prison term of 78 months, along with three years’ supervised release. Under the terms of his plea agreement, Bowdoin potentially faces court supervision for the next 9 and a half years.

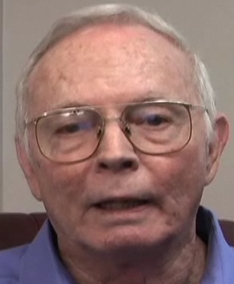

During Thursday’s call, Mann — an older man, like Bowdoin — did not rule out the possibility that his program could encounter an ASD-like intervention by the government.

“The slavemasters don’t want their slaves to escape,” Mann said, casting the U.S. government as wicked.

“What you need to realize is that the de facto U.S. Constitution is ‘anything goes’ that we can get away with. So, that’s how Obama operates. That’s how Romney would operate if he were elected President. That’s how George Bush operates.”

Like ASD, JSS/JBP may have ties or be sympathetic to the so-called “sovereign citizen” movement. “Sovereign citizens” have an irrational belief that laws do not apply to them. JSS/JBP is so secretive that the “opportunity” does not identify where it is operating from and makes members affirm they are not with the “government.”

After a caller asked Mann Thursday about ASD, Mann said this:

“If they want to arrest people and take their money, they will find some pretext.”

HYIPs operate as virtually pure Ponzi schemes. Victims can pile up by the tens of thousands in a single scheme. The schemes redistribute wealth from the masses and put it in the hands of a select few.

Bowdoin’s Statement

Before getting into some of the specifics of Bowdoin’s signed statement — a statement also signed by Bowdoin’s attorney Charles A. Murray and a federal prosecutor — it perhaps is worth noting that Bowdoin’s plea agreement contains this provision to which Bowdoin agreed in writing: “Your client represents to the Court that his attorney has rendered effective assistance.” (Italics added.)

Though boilerplate language, it is important in the context of Bowdoin’s history. Indeed, he has a history of publicly blaming lawyers for his problems. In 2011, for example, he appeared in a video solicitation in which he asked the people he now admits he defrauded to pay for his criminal defense. Bowdoin blamed his prior counsel, a federal judge, two federal prosecutors and three agents of the U.S. Secret Service for his predicament. The final page of the plea agreement contains this language to which Bowdoin agreed in writing:

“I have read this Plea Agreement and discussed it with my attorneys, Michael McDonnell, Esq. and Charles Murray, Esq. I fully understand this Plea Agreement and agree to it without reservation. I do this voluntarily and of my own free will, intending to be legally bound. No threats have been made against me nor am I under the influence of anything that could impede my ability to understand this Plea Agreement fully. I am pleading guilty because I am in fact guilty of the offense(s) identified in this Plea Agreement.” (Italics/bolding added)

Because of the plea agreement and the MLM/Internet/mass-marketing bans, Bowdoin’s role as an an online pitchman for a program known as “OneX” has ended.

In essence, because of what Bowdoin did in ASD — and allegedly what he continued to do even after being arrested for running a Ponzi scheme — Bowdoin has been banned from MLM, kicked out of the business side of the Web and barred from making mass solicitations in any form.

Prosecutors said last month that OneX was a “fraudulent scheme” and “pyramid” that was recycling money to members in ASD-like fashion. Bowdoin was arrested on ASD-related charges in December 2010. In October 2011 — 10 months after his arrest — he told OneX prospects that God had provided the OneX program and that he intended to use money from the scheme to pay for his criminal defense.

On Tuesday — just three days before Bowdoin pleaded guilty to a felony for his operation of ASD — a fellow OneX pitchman described Bowdoin as “our Mentor.”

Here, now, some highlights from Bowdoin’s signed “Statement of Offense” — along with editorial notes. Bolding added by the PP Blog . . .

1.) “Bowdoin called ASD’s operation a revenue-sharing advertising program . . .” (NOTE: All kinds of HYIP schemes use the phrase “revenue sharing” as a means of masking the Ponzi elements. The phrase, for example, appears on the website of JSS/JBP. It “works” because it sounds plausible. After all, many businesses share revenue legally. The connection many new HYIP enlistees do not make is that scammers have co-opted the term to sanitize their fraud schemes.)

2.) “But, contrary to its representations, the advertising packages sold by ASD generated insufficient revenue to fund the returns it promised to the members. Instead, ASD operated as a ‘Ponzi’ scheme.” (NOTE: ASD members Dwight Owen Schweitzer and Todd Disner sued the government last year, alleging that ASD was a legitimate business. Bowdoin now publicly disagrees with them, based on his admission that ASD was a Ponzi scheme.)

3.) “Throughout ASD’s operation, Bowdoin was aware that ASD was an illegal money making business, and that he was intentionally defrauding ASD members.”

4.) ASD, according to Bowdoin’s statement, actually gathered more than “$119 million” from members. (NOTE: This figure is about $9 million higher than the rough amount of $110 million cited by the government in previous filings. The PP Blog will check next week to see if it can confirm that the $119 million figure is the final sum identified after investigation. As things stand, both Bowdoin and the government agree on the $119 million figure.)

5.) ASD made more than $45 million in Ponzi payments and spent more than $10 million on operations. About $1.161 million was directed at Bowdoin or his family.

6.) During ASD’s initial iteration at AdSurfDaily.com, Bowdoin realized “[a]fter only a few months of operation” that ASD was in over its head “because he was not selling any independent products or services sufficient to generate an income stream needed to support the returns and commissions ASD was paying . . .” (NOTE: The JSS/JBP scheme has a commission-payout scheme (two tiers, one paying 10 percent the other 5 percent) that is virtually identical to ASD. Incredibly, JSS/JBP says it can pay double ASD’s daily return of 1 percent on top of the two-tiered commissions.)

7.) “In approximately March 2007, Bowdoin ceased ASD’s operations because it was paying out money to its employees and members faster than it was taking in new money.” (NOTE: Bowdoin’s concession proves the government’s longstanding theory that ASD collapsed in its original iteration because of the Ponzi pressure. At one point, according to court filings, Bowdoin blamed ASD’s inability to pay on script problems and a purported theft of $1 million by “Russian” hackers.)

8.) Bowdoin — instead of getting out of the Ponzi business — thereafter launched ASD under a new name at a new website: ASDCashGenerator.com. Bowdoin, according to his statement, admits he made some cosmetic tweaks — lowering the return from 150 percent to 125 percent, for example. “By not changing ASD’s business model in any meaningful way, Bowdoin continued to intentionally defraud members.” (NOTE: It is common in the HYIP fraud sphere for “admins” to claim they’ve employed tweaks to take Ponzi issues out of play. An obvious Ponzi scheme known as JSS Tripler 2 appears recently to have employed some Bowdoin-like tweaks, including a name change to T2MoneyKlub — while adding to its claims that the “opportunity” had income streams sufficient to pay an absurd return of 2 percent a day on top of referral commissions.)

9.) Bowdoin never told his second group of fraud victims that they were paying for the fraud Bowdoin committed against his first group of victims.

10.) “Bowdoin also intentionally failed to explain to old and new members that, in the 1990s, he was convicted in Alabama of three securities-related crimes, charged in Alabama in at least 13 additional indictments alleging securities fraud, and barred from ever selling securities in Alabama.”

11.) Bowdoin compounded lies told about his lack of a criminal record by permitting lies to be told about an award for business achievement purportedly given Bowdoin by President George W. Bush. The “award” actually was a memento from the National Republican Congressional Committee (NRCC) that was “entirely dependent” on a Bowdoin money contrbution to NRCC of $25,000 “and was not based on Bowdoin’s business acumen or any other evaluation of his prior business practices.”