EDITOR’S NOTE: The filing by Todd Disner and Dwight Owen Schweitzer to which the PP Blog refers in this story was in response to a May 18 government motion to dismiss a lawsuit filed by Disner and Schweitzer against the United States in the Southern District of Florida or to transfer the case to U.S. District Court for the District of Columbia. The government filed its motions on the same date ASD President Andy Bowdoin pleaded guilty to wire fraud and admitted that ASD was a Ponzi scheme . . .

BULLETIN: In a curious, 23-page narrative, AdSurfDaily figures Todd Disner and Dwight Owen Schweitzer — who went on to become promoters of the Zeek Rewards MLM — have raised the prospect that they could be prosecuted for tax evasion because of the government seizure of ASD’s database in August 2008.

Neither Disner nor Schweitzer referenced Zeek in a filing stamped June 15 and entered today on the docket of U.S. District Judge Cecilia M. Altonaga of the Southern District of Florida. But the filing includes the name of Zeek consultant Keith Laggos, positioning Laggos as an expert on Ponzi schemes who ventured an opinion that ASD was not a Ponzi scheme.

The Disner/Schweitzer filing does not mention that Laggos repeatedly misspelled “Ponzi” as “Ponzie” in his purported expert opinion in the ASD case. Nor does it mention that Laggos was prosecuted by the SEC in a 2004 case that alleged he issued laudatory press releases and a laudatory article for a company that later become the subject of a securities investigation without disclosing he was being compensated for touting the purported opportunity.

Laggos neither admitted nor denied the SEC’s allegations, which involved a company known as Converge Global Inc. and a subsidiary known as TeleWrx Inc. The future Zeek consultant settled the 2004 SEC case by disgorging nearly $12,000, paying interest of nearly $2,000, paying a civil fine of $19,500 and agreeing to a five-year penny-stock ban.

Laggos was permanently enjoined in the case from violating Section 17(b) of the Securities Act, which makes it unlawful to tout a stock without disclosing the nature and substance of any consideration, whether present or future, direct or indirect, received from an issuer, underwriter or dealer.

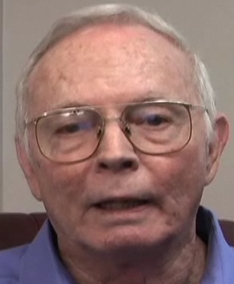

An image of Laggos now appears in a commercial for Zeek, and a publication owned by Laggos has issued laudatory coverage of the purported MLM opportunity, which plants the seed it provides a return of between 1 percent and 2 percent a day without being a “pyramid scheme” and without constituting an investment opportunity.

It is known that Zeek and ASD had common promoters and that, beginning in about July 2011, some well-known figures in the ASD story began to emerge publicly as Zeek boosters. Among them are former “Surf’s Up” moderator Terralynn Hoy and former ASD pitchman Jerry Napier.

Hoy, who has been listed as a “Zeek” employee and has hosted at least once conference call for Zeek, was a moderator of a defunct ASD cheerleading forum known as “Surf’s Up.” While “Surf’s Up” still was operating, Hoy became a moderator of a forum that led cheers for an autosurf known as AdViewGlobal, which federal prosecutors now say was a fraudulent scheme backed by ASD President Andy Bowdoin. Both Surf’s Up and the AdViewGlobal forum, which also now is defunct, described ASD figure and purported “sovereign citizen” Curtis Richmond as a “hero.”

Richmond has a contempt of court conviction for threatening federal judges and once was sued successfully under the federal racketeering statute for participating in a scheme in which enormous purported judgments were filed against public officials and the officials were threatened with arrest. ASD is known to have had ties to tax deniers and “sovereign citizens.”

Some Zeek promoters also are pushing a purported “opportunity” known as JSS Tripler/JustBeenPaid that may have links to the “sovereign citizens” movement. Frederick Mann, the purported operator of JSS/JBP, does not identify where the purported opportunity operates from and has speculated that the servers of JSS/JBP could be targeted in a “cruise missile” attack by the government.

JSS/JBP advertises a return of 2 percent a day, a percentage that Zeek sometimes says it has matched or exceeded — though Zeek generally stays between 1 percent and 2 percent a day when the purported payout is averaged over a week, Zeek promoters claim.

As a Zeek promoter, Napier was given a puff piece last summer by the purported Zeek opportunity. An individual with the same name appears to have signed a petition in December 2008 calling for the U.S. Senate not to investigate ASD and Bowdoin, but to investigate various federal prosecutors and the U.S. Secret Service agent who brought the ASD Ponzi case in August 2008. The petition showing the name of “Jerry Napier” appears to have been signed by “Jerry Napier” after federal prosecutors brought a second forfeiture case against ASD-related assets on Dec. 19, 2008. As was the case with the August 2008 forfeiture filing by the government, the December 2008 case alleged a Ponzi scheme.

Today’s filing by Disner and Schweitzer advances a theory — even after Bowdoin’s guilty plea to wire fraud last month and public acknowledgment that he presided over a Ponzi scheme — that the government’s Ponzi claims constituted a “house of cards.”

It also plants the seed that prosecutors shopped the ASD case to a “frendly [sic] forum” in the District of Columbia to make it easier for the government to enlist “some of their Washington D.C. operatives to become members of ASD, thereby making them potential witnesses.”

Disner and Schweitzer claim that the seizure of ASD’s database in Florida was unconstitutional because it subjected them to an invasion of privacy and potentially a tax investigation.

“The plaintiffs have alleged that the information taken by the defendant places the plaintiffs in jeopardy of the defendant seeking to prosecute the plaintiffs for tax evasion as a result of the defendant having taken the plaintiffs records which are necessary to enable the plaintiffs to file accurate tax returns for the period covered by those records,” Disner and Schweitzer argued.

And Disner and Schweitzer further ventured (italics added):

As a result of the government’s action, the plaintiffs cannot file accurate tax returns, have lost both past and future business revenues, their reputations have been damaged to the extent that they recruited others to join in the program that the defendant alleged to be a Ponzi scheme, and by inference the plaintiffs have therefore enlisted others to participate in an illegal enterprise. The injuries suffered by the plaintiffs are not hypothetical or conjectural but are both finite and calculable. They have alleged that the actions taken against them were authorized without meeting the constitutionally guaranteed and statutorily increased requirements to establish probable cause and resulted in an illegal search and seizure of their property and effects.

Neither Zeek nor any of its executives or promoters have been accused of wrongdoing. Zeek, though, claimed last month that it was closing two U.S. bank accounts and looking to open an account with a bank it did not name.

Zeek is using offshore payment processors linked to numerous schemes that promote outsize returns. A Zeek auction arm known as Zeekler is auctioning sums of U.S. cash and telling winners it will pay them via offshore processors.

Components of the Zeek scheme are similar to components of the ASD Ponzi scheme.

In 2008, an HYIP scheme known as Legisi resulted in an an SEC civil prosecution. Court papers showed that the U.S. Secret Service and state regulators in Michigan were conducting an undercover probe of Legisi which, like JSS/JBP, sought to make participants affirm they were not government employees.

Like ASD’s Bowdoin, Legisi operator Gregory McKnight pleaded guilty to wire fraud. Records show that a tier of the purported Legisi program offered a daily return that was about one-fourth the daily return Zeek plants the seed can be realized through its purported opportunity.

Although Surf’s Up, which received ASD’s official endorsement as a news outlet with Hoy as a moderator, led cheers for ASD and Bowdoin until the forum mysteriously vanished in January 2010, Hoy appears to believe that Ponzi schemes actually can exist.

SSH2 Acquisitions, a Nevada company that listed Hoy as a director, claimed in 2010 that it had been defrauded in a Ponzi scheme.