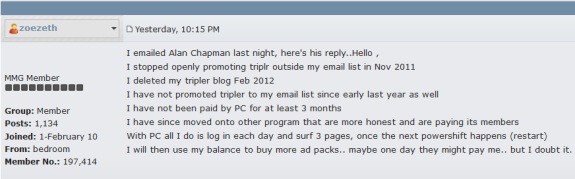

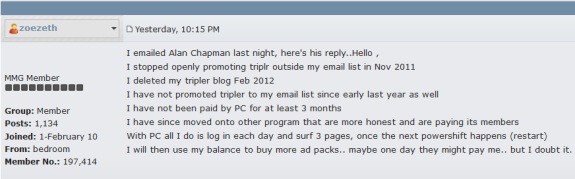

Former Zeek Rewards and JSSTripler/JustBeenPaid pitchman “Alan Chapman” reportedly now claims he hasn’t been paid by “ProfitClicking” for “at least 3 months,” according to a post quoting “Chapman” on the MoneyMakerGroup Ponzi forum.

Former Zeek Rewards and JSSTripler/JustBeenPaid pitchman “Alan Chapman” reportedly now claims he hasn’t been paid by “ProfitClicking” for “at least 3 months,” according to a post quoting “Chapman” on the MoneyMakerGroup Ponzi forum.

ProfitClicking is the absurd follow-up “program” to the bizarre JSS/JBP scam, a 730-percent-a-year “opportunity” purportedly operated by Frederick Mann. JSS/JBP may have had ties to the “sovereign citizens” movement. Like ProfitClicking, the JSS/JBP “program” made members affirm they were not with the “government.”

On Aug. 17, the SEC described Zeek as a $600 million Ponzi and pyramid scheme that was selling unregistered securities to sustain a massive fraud that duped members into believing it provided a legitimate return averaging 1.5 percent a day. Just a day earlier, JSS/JBP took a page from the Zeek playbook, asserting that it was not selling securities and members were not making an investment.

After the SEC’s Zeek action, JSS/JBP morphed into ProfitClicking, amid reports of the sudden retirement of Mann, a former pitchman for the AdSurfDaily Ponzi scheme. On Sept. 5, the PP Blog received a menacing communication threatening a lawsuit over its coverage of JSS/JBP/ProfitClicking. The lawsuit threat was made after the Blog reported that ProfitClicking was disclaiming any responsibility on the part of itself or its affiliates for offering the “program.”

Like Zeek, JSS/JBP/ProfitClicking was promoted on forums listed in U.S. federal court files as places from which Ponzi schemes are promoted. In the hours after the SEC action, the PP Blog began to receive spam for a “program” known as “Ultimate Power Profits.” A check of the MoneyMakerGroup Ponzi forum showed that Zeek peddler “mmgcjm” was the key pitchmen for Ultimate Power Profits.

The connectivity of the various scams shows how banks and financial vendors can come into possession of funds tainted by fraud schemes. Meanwhile, the court-appointed receiver in the Zeek case said last month that he had “obtained information indicating that large sums of Receivership Assets may have been transferred by net winners to other entities in order to hide or shelter those assets.”

“Chapman” was an apparent Diamond affiliate of Zeek. In June 2012 — apparently even as the SEC’s Zeek probe already was under way — a “Chapman” Blog known as “ZeekRewardsPays” asserted this (italics added):

ZeekRewards Daily Profit Last 7 Days!

June 11 2012 1.89 %

JUNE 10 2012 0.88 %

JUNE 09 2012 0.96 %

JUNE 08 2012 0.92 %

JUNE 07 2012 1.91 %

JUNE 06 2012 2.00 %

JUNE 05 2012 1.93 %

Court filings by the SEC last week suggest its Zeek probe began in April 2012 and perhaps earlier. What’s not known is when Zeek learned it was under investigation. It is not unusual for law enforcement to maintain secrecy when a “program” hits its radar screens. Court filings from 2008 show that the U.S. Secret Service had infiltrated AdSurfDaily with undercover agents who corresponded with ASD promoters prior to any public announcement of a probe.

At least one ASD member instructed an undercover agent not to call the “program” an investment, apparently based on the errant belief that wordplay designed to disguise ASD as an “advertising” program and not a program offering unregistered securities and unusually consistent returns at a preposterous rate of 1 percent a day somehow could insulate ASD from prosecution.

On Aug. 1, 2008, the Secret Service began the process of seizing more than $80 million from ASD-related bank accounts, alleging that the “opportunity” was a massive online Ponzi scheme. ASD, Zeek, JSS/JBP and Profit Clicking planted the seed they provided returns that made Bernard Madoff look like a piker. Viewed on an annualized basis, the “programs” effectively were asserting they could outperform Madoff by a factor on the order of between 30 and 70 to one.

The assertion by “Chapman” (as noted above) computed to an average daily return of 1.498 percent. On Aug. 17, the SEC said that Zeek operator Paul R. Burks “unilaterally and arbitrarily determines the daily dividend rate so that it averages approximately 1.5% per day, giving investors the false impression that the business is profitable.”

Burks consented to a judgment on the same day the SEC brought the Zeek Ponzi action. The U.S. Secret Service — also on Aug. 17 — announced it was investigating Zeek. In 2008, the Secret Service brought Ponzi allegations against ASD’s 1-percent-a-day “program.” ASD operator Andy Bowdoin later admitted he was running a Ponzi scheme. Bowdoin was sentenced to 78 months in federal prison. He is 78 years old.

Mann’s age is unknown. There have been reports he is in his eighties.