UPDATED 1:04 P.M. (JULY 5, U.S.A.) Quoting a prosecutor, the website of iG — a Brazilian communications provider — is reporting that the TelexFree MLM “program” allegedly diverted $88 million after a judge in the state of Acre blocked payments as a pyramid-scheme probe got under way last month.

UPDATED 1:04 P.M. (JULY 5, U.S.A.) Quoting a prosecutor, the website of iG — a Brazilian communications provider — is reporting that the TelexFree MLM “program” allegedly diverted $88 million after a judge in the state of Acre blocked payments as a pyramid-scheme probe got under way last month.

TelexFree also operates in the United States. The “program” has been pitched to victims of the murky Profitable Sunrise “opportunity,” which the U.S. Securities and Exchange Commission described in April as a pyramid scheme that may have collected tens of millions of dollars through offshore bank accounts.

At least one U.S. video pitch for TelexFree described the purported opportunity as a “program” that provided a guaranteed payout of at least $1,100 per week for a year to individuals who sent in $15,125 for the purchase of a “contract.” TelexFree has been under investigation in Brazil for weeks. Behind MLM.com is reporting that seven Brazilian states have opened probes.

Here is a link to a Google translation in English of today’s iG story.

Whether U.S. investigators have opened probes into TelexFree is unknown. The opportunity, however, may have U.S. exposure to charges it is selling unregistered securities as investment contracts. MLM “programs” such as Zeek Rewards and Profitable Sunrise have been shut down under U.S. securities laws.

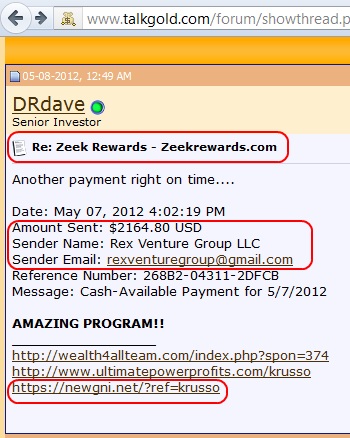

Like Zeek Rewards and Profitable Sunrise, TelexFree has a presence on well-known Ponzi-scheme forums such as TalkGold and MoneyMakerGroup.

Such MLM “programs” typically have promoters in common, a circumstance that raise questions about whether promoters are engaging in willful blindness and polluting banks both domestic and across national borders with unlawful proceeds from scams that may have ties to organized crime — or worse. TelexFree purports to be in the communications business.

In August 2012, the SEC described Zeek Rewards as a $600 million Ponzi- and pyramid scheme operating from Lexington, N.C. The precise base of operations of Profitable Sunrise remains unclear. The SEC said it used a “mail drop” in England.

HYIP schemes typically generate protests when governments move against them. Such appears to be the case with TelexFree, which appears to have affiliates willing to march in the streets in apparent “defense” of the “program.”

As was the case among certain Zeek Rewards affiliates in the United States, certain affiliates of TelexFree in Brazil appear to be engaged in efforts to demonize law enforcement and to chill courts or enforcement agencies. After the AdSurfDaily Ponzi scheme was exposed in the United States in 2008, bogus liens seeking billions of dollars were filed against public officials.

Because money directed at HYIP schemes typically involves transfers among any number of conduits to keep schemes afloat, law-enforcement agencies often seek asset freezes to prevent the movement of money. In the absence of such freezes or if freeze orders are ignored, less money may be available to compensate victims if an investigation ultimately reveals fraud has occurred.

Large promoters typically gain the lion’s share of HYIP proceeds at the expense of their recruits. The operators of the schemes may siphon millions of dollars along the way even as they make classic Ponzi payouts to promoters to create an air of legitimacy.