UPDATED 11:28 P.M. EDT (U.S.A.) Scammers have used the names of government agencies and famous businesses in bids to dupe the public. Now, the name of a well-known MLM law firm appears to have been used for the same purpose.

Attorney Kevin Thompson published a Blog post today that warns of a bogus Banners Broker/Profit Clicking “Claim Form” on the Web. Thompson is with Thompson Burton PLLC in Tennessee.

“DO NOT FILL OUT THIS FORM,” Thompson warned in the post. “It’s fraudulent. We did not create this form, or anything like it. We are not representing Banners Brokers or Profit Clicking participants.”

And, Thompson noted, “The form is requiring highly sensitive information, such as your usernames and passwords for Payza and Solid Trust Pay accounts. It’s also asking for credit card information. If you filled out the form, we strongly suggest you change your passwords and cancel your credit cards immediately.”

Such events have been associated with phishing schemes and identity-theft schemes.

Banners Broker is a bizarre “program” that, like many HYIPs, purports to be in the “advertising” business. Promoters have claimed that sending money to Banners Broker results in a doubling of the cash.

ProfitClicking is a scam that rose up to replace the JSSTripler/JustBeenPaid scam purportedly operated by Frederick Mann. Mann, a former pitchman for the AdSurfDaily Ponzi scheme, may have links to the “sovereign citizens movement.” “Sovereign citizens” may express an irrational belief that laws do not apply to them.

Among other things, ProfitClicking became known — like JSS/JBP before it — for publishing Terms that read like an invitation to join an international financial conspiracy. Here is Item 6 from the ProfitClicking Terms, as published on Sept. 3, 2012 (italics added):

6. I affirm that I am not an employee or official of any government agency, nor am I acting on behalf of or collecting information for or on behalf of any government agency.

Mann once called government employees “part of a criminal gang of robbers, thieves, murderers, liars, imposters.”

Regulators in Italy and the Philippines have issued warnings about JSS/JBP or ProfitClicking, both of which featured Terms similar to those of Legisi, a $72 million HYIP fraud scheme broken up by the SEC and the U.S. Secret Service in May 2008, about three months before the AdSurfDaily Ponzi scheme ($119 million) was exposed.

The PP Blog has been subjected to various bids to chill its reporting on the JSS/JPB/ProfitClicking scams, including one from an individual who claimed he’d defend Mann “so help me God.”

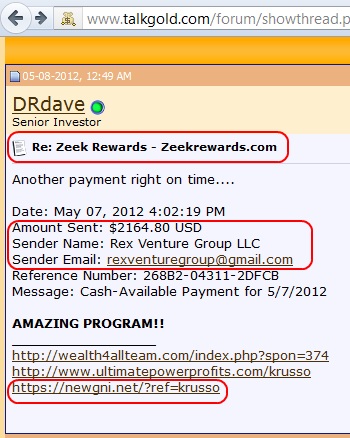

Meanwhile, the PP Blog has received bizarre and menacing spam apparently in support of Banners Broker. (Like JSS/JBP/ProfitClicking, AdSurfDaily, Legisi and Zeek Rewards, Banners Broker has a presence on well-known Ponzi-scheme forums such as TalkGold and MoneyMakerGroup.)

WARNING: The next paragraph includes quoted material from one of the Jan. 18, 2013, spams, and the PP Blog is reproducing it to illustrate the bizarre and often menacing nature of the HYIP sphere. Indeed, the apparent Banner’s Broker supporter wrote (italics added):

” . . . I am Big Bob’s cock meat sandwich. Your mom ate me and made me do press ups until I threw up . . . I am gonna report you. When you make false accusations, you can get done. Maybe you will be seen in court soon . . .”

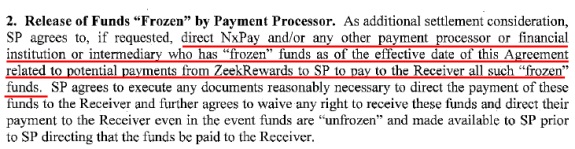

In August 2012, the SEC described Zeek Rewards as a $600 million Ponzi- and pyramid scheme. A number of reload scams have surfaced in its wake. At least one appears to have been a bid to dupe people into sending money to an entity that was posing as a U.S. government agency while claiming to be a recovery vessel for Zeek members who lost money.

Thompson is encouraging people who may have information about the purported Banners Broker/Profit Clicking “Claim Form” to contact him here.

![Andrew Neil yesterday made the universal "[batspit] crazy" gesture after trying to interview Alex Jones of InfoWars.](https://patrickpretty.com/wp-content/uploads/2013/06/andrewneilbbc.jpg)