(2ND UPDATE 3:26 P.M. EDT U.S.A.) Rod Cook, who publishes the “MLM Watchdog” and was threatened with a $40 million lawsuit by the AdSurfDaily Ponzi racketeers in 2008, is reporting that veteran swindler Phil Piccolo is back on the prowl.

(2ND UPDATE 3:26 P.M. EDT U.S.A.) Rod Cook, who publishes the “MLM Watchdog” and was threatened with a $40 million lawsuit by the AdSurfDaily Ponzi racketeers in 2008, is reporting that veteran swindler Phil Piccolo is back on the prowl.

This time, Cook reports, it’s with a cobra-venom product sold at MyNyloxin.com. The product is positioned as a pain reliever, and Piccolo is calling himself “Felice Angelo.”

Piccolo is known as “the one-man Internet crime wave.” If there’s a Piccolo signature, it’s his ability largely (though not exclusively) to remain in the shadows while engineering scams within scams or within dubious “opportunities” in which an affiliate’s success chances are exceptionally low going in. Piccolo appears to be particularly keen on “programs” ostensibly in the health-maintenance and electronic-technology fields. The “programs” may remain in “prelaunch” phase virtually indefinitely while gathering cash and gaining a head of steam.

“[P]hil is selling his stock to individuals and giving it away as incentives under the table illegally and running $500 co-ops scamming people out of their money,” Cook reports about Piccolo’s MyNyloxin activities.

Based on the PP Blog’s research, Piccolo also is known to engage in anonymous shilling and to leave thousands of orphaned affiliate links of his onetime recruits all over the web as a means of corralling the earnings of people duped into placing the links before they fled the programs because they weren’t getting paid.

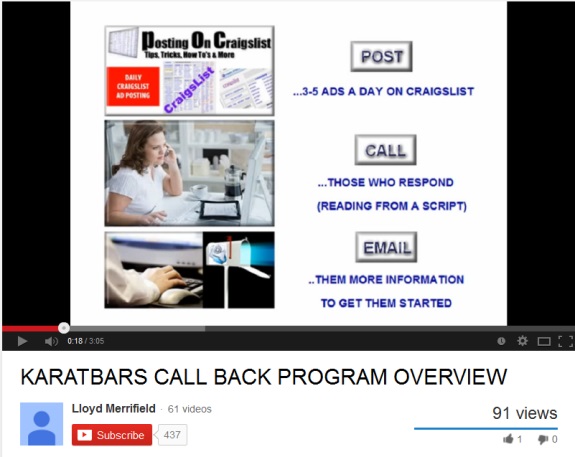

PP Blog reader Tony H. noted on March 4 that a “Piccolo Felix Angelo” was listed as a “winner” in the $850 million Zeek Rewards Ponzi-scheme and was being sued by the court-appointed receiver.

As the PP Blog previously has reported, Piccolo has a history of threatening websites that report on his scams. Part of his MO features appeals to religious faith. These incongruously have been mixed with suggestions he can summon leg-breakers if the need arises.

Piccolo claims to hail from New York. He is known to operate in the region of Boca Raton, Fla., and to participate in scams that try to create the illusion of scale — perhaps by using Photoshop to make the scamming firm’s name appear on a large building, for example.

Another part of Piccolo’s MO includes suggestions that “opportunities” he pitches soon will “go public” or already are part of public companies. In the TextCashNetwork scheme, for instance, the Piccolo group suggested that TCN was part of Johnson & Johnson, the famous pharmaceutical company.

Meanwhile, Piccolo scams may feature claims that people who send in large sums of money will receive a preposterous return, a marker that the “programs” are vulnerable to charges they are selling unregistered securities as investment contracts. If a Piccolo-associated scheme loses its payment conduits, recruits have been encouraged to wire money via Western Union.

Piccolo scams also have featured claims that celebrities such as billionaire Donald Trump and entertainment icon Oprah Winfrey were on the ships he helped steer. Such was the case with a scam known as Data Network Affiliates — DNA, for short.

DNA claimed to be in the business of assisting the Amber Alert system of rescuing abducted children. It later claimed to be in the cellphone, offshore “resorts” and mortgage-assistance businesses. DNA was targeted at churches, with prospects told they had the moral obligation to enroll the faithful.

Piccolo also was associated with a business known as “One World One Website” (OWOW) that suggested a bottled-water product could cure cancer and had been vetted by the National Institutes of Health.

Over the years, Piccolo has pushed products such as a purported license-plate “spray” positioned as a means of helping motorists escape traffic tickets at camera-monitored intersections. Perhaps most notoriously, Piccolo has pitched a purported “magnetic” product that purportedly could help medical patients escape limb-amputation procedures while at once helping gardeners/farmers produce tomatoes at twice their normal size. The scam also included a claim that the “magnetic” product could help dairy herds increase milk production.

Perhaps most infamously, the Piccolo group in the DNA scam traded on the name of Adam Walsh, a child who’d been abducted and murdered. Piccolo employs anything that “works,” even the memory of a slain 6-year-old.

Piccolo scams typically also feature the presence of MLM huckster Joe Reid. The scams also may include suggestions that affiliates should enroll as a means of qualifying for tax write-offs. In a typical Piccolo scam, an increase in Alexa rankings is positioned as asserted proof of an MLM “program’s” legitimacy. The Piccolo scams also typically feature a link to Google’s translation tool, potentially as a means of picking off nonspeakers of English.

Some Piccolo scams have featured the registrations of shell companies in Wyoming.

In 2010, the PP Blog was accused by an apparent Piccolo apologist of being a shill for Israel and spreading “Islamophobia.” This claim was made after the Blog reported that the FBI had stopped a plot to detonate a bomb at a Christmas tree lighting ceremony in Portland, Ore.

Also see: Nov. 13, 2011, PP Blog story: ‘TEXT CASH NETWORK’: RED FLAGS GALORE: New ‘Opportunity’ Linked To Ponzi Boards And To Phil Piccolo-Associated ‘Firms’: Hype, Vapid Claims, Alexa Charts, Launch Countdown Timer, Brand Leeching — And Possible Ties To Long-Running SEC Case

Also see this Jan. 16, 2014, comment by PP Blog reader and RealScam.com moderator Glim Dropper. The comment appears below an Aug. 30, 2013, PP Blog story titled, “Zeekers Targeted In New Scheme With Ties To Piccolo Organization.”