A “program” the PP Blog reported may have ties to the so-called “sovereign citizens” movement appears to have wiped out investors and perhaps zeroed out the purported earnings of many of them, according to posts at the MoneyMakerGroup Ponzi-scheme forum.

In fact, according to one post, the “ProfitClicking” program perhaps now can be best described as “Profitcrapping.”

ProfitClicking listed Liberty Reserve as one of its payment processors. On Tuesday, federal prosecutors in New York described Liberty Reserve as a massive criminal enterprise involved in the laundering of more than $6 billion. The effect of the Liberty Reserve action on Profit Clicking was not immediately clear.

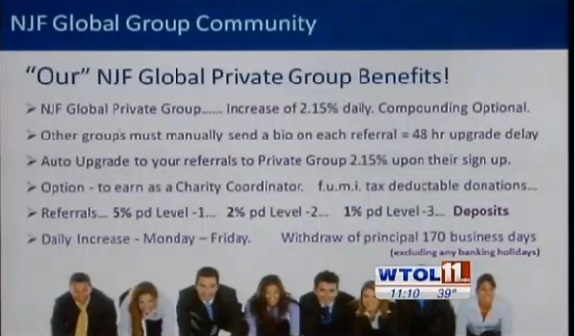

What is clear is that ProfitClicking was a fraud from the start. The “program” traces its roots to JSSTripler/JustBeenPaid, which promised a daily payout of 2 percent and purportedly was operated by Frederick Mann, a one-time pitchman for the collapsed, 1-percent-a-day AdSurfDaily Ponzi scheme. ProfitClicking surfaced after Mann purportedly retired suddenly in the days after the SEC took down Zeek Rewards in August 2012, amid allegations it had operated a $600 million Ponzi- and pyramid fraud that had duped investors into believing it provided a legitimate payout averaging about 1.5 percent a day.

Prior to the emergence of ProfitClicking, Mann speculated that his JSS/JBP “program” could come under attack by American cruise missiles. He also has described U.S. government employees as “part of a criminal gang of robbers, thieves, murderers, liars, imposters.”

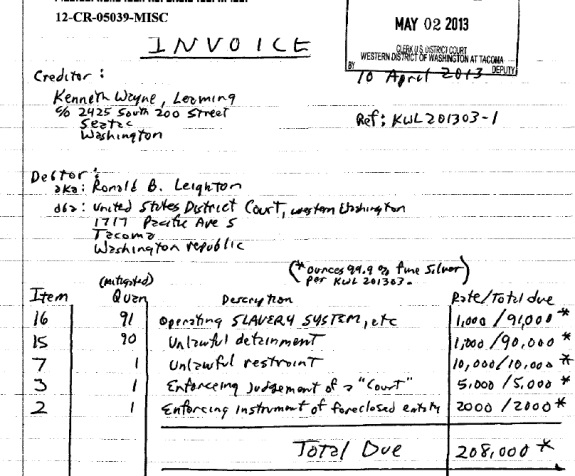

Taking the time to ensure JSS/JBP was operating legally was a concession to slavery, Mann contended. Fellow AdSurfDaily figure Kenneth Wayne Leaming, a purported sovereign convicted in a plot to file false liens for billions of dollars against U.S. government employees, later contended that he was being held as a slave against his will.

But even as Mann was sliming the U.S. government and calling its employees slavemasters, one of his JSS/JBP pitchmen was operating a site known as Vatican Assassins that contended “Majority Savage Blacks were never taught to behave in civil White Protestant culture and thus have been released upon us Reformation Bible-believing Whites to further destroy our once White Protestant and Baptist American culture founded upon the Reformation’s AV1611 English Bible and a White Protestant Presbyterian Constitution with its attached White Baptist-Calvinist Bill of Rights.”

Some analysts have speculated that the name “Frederick Mann” (emphasis by PP Blog) is longhand code for “free man.” Purported “sovereign citizens” sometimes calls themselves “free men of the land.”

Among other things, both JSS/JBP and ProfitClicking made members affirm they were not with the “government.” Mann declined to say where his “program” was operating from, a development that drew comparisons to the infamous BCCI banking scheme of the 1990s. BCCI, shorthand for Bank of Credit and Commerce International, purportedly was designed to be “offshore everywhere,”

Liberty Reserve also has drawn such comparisons. (Link is to May 28 article in Vanity Fair.)

Mann fell out of the Ponzi spotlight for a brief time after his purported retirement from JSS/JBP as ProfitClicking was gaining a head of steam.

He soon was back, however — this time as a pitchmen for a “program” known as ClickPaid.

The ClickPaid Terms — like the Terms of JSS/JBP and ProfitClicking — made members affirm they are not with the “government.”

On May 29, the PP Blog reported that the Securities and Exchange Commission of the Republic of the Philippines had issued a warning on the JSSTripler/JustBeenPaid and ProfitClicking scams. JSS/JBP also came under investigation in Italy.

A Ponzi-board program known as “Profitable Sunrise” also experienced the same fate in Italy.

The U.S. SEC has described Profitable Sunrise as a murky “program” that may have collected tens of millions of dollars through offshore bank accounts. Profitable Sunrise had five HYIP plans, including one bizarrely dubbed the “Long Haul,” which purported to pay 2.7 percent a day — more than Zeek, more than ASD, more than JSS/JBP, more than ProfitClicking, more than ClickPaid.

A website linked to Mann once linked to videos featuring Francis Schaeffer Cox, a purported “sovereign” and “militia” man implicated in a murder plot against public officials in Alaska.