EDITOR’S NOTE: One way to read a report filed yesterday by the court-appointed receiver in the Zeek Rewards Ponzi-scheme case is as a warning manual that brings to life the kind of vexing problems HYIP schemes create for operators, vendors and participants — including “insiders.” Kenneth D. Bell’s report to Senior U.S. District Judge Graham C. Mullen of North Carolina strongly hints that the receivership has identified “key insiders.” Their names have not been published in court filings . . .

UPDATED 4 P.M. EDT (U.S.A.) Although early filings last year in the Zeek Rewards Ponzi scheme case suggested that offshore payment processors Alert Pay (Payza) and Solid Trust Pay held more than $40 million connected to Zeek, the court-appointed receiver has advised a federal judge that the two processors may hold even more than originally believed.

UPDATED 4 P.M. EDT (U.S.A.) Although early filings last year in the Zeek Rewards Ponzi scheme case suggested that offshore payment processors Alert Pay (Payza) and Solid Trust Pay held more than $40 million connected to Zeek, the court-appointed receiver has advised a federal judge that the two processors may hold even more than originally believed.

Both AlertPay and SolidTrustPay operate from Canada. Their names appear constantly in Ponzi-board promos for fraud schemes. The companies’ names also have appeared in court filings related to various HYIP schemes, including the alleged $72 million Pathway To Prosperity fraud in 2010 and the $119 million AdSurfDaily fraud in 2008.

In 2009, while the ASD case was still in the courts, some members of AdSurfDaily received mysterious “final refunds” from SolidTrustPay through an STP-connected email address of oceannamusic@xplornet.com. The purported pro rata refunds led to questions about whether some ASD members were benefiting at the expense of others while the case still was in the U.S. courts and whether ASD actually had money in SolidTrustPay under the name of a different company or a user other than President Andy Bowdoin. (See July 2009 post by PP Blog guest columnist Gregg Evans here.)

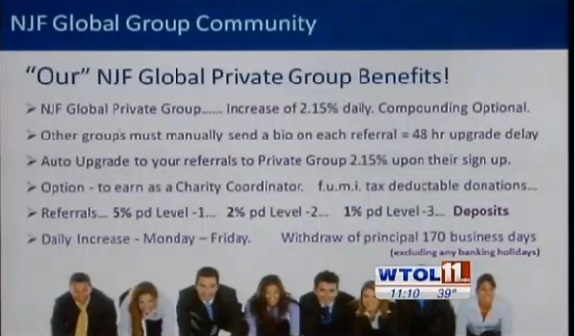

Later, an emerging scam known as JSSTripler/JustBeenPaid purportedly operated by former ASD pitchman Frederick Mann began to use the offshore processors — amid claims from JSS/JPB pitchmen that they not only were recruiting for JSS/JBP, but also managing both the JSS/JBP accounts of their sign-ups and the payment-processor accounts of the sign-ups.

Because HYIP schemes proliferate in part through the willful blindness of promoters and serial con artists, a situation has evolved over the years in which fraudulent proceeds circulate between and among scams and their individual promoters. “Alan Chapman,” a Zeek pitchman, also was promoting JSS/JPB and a follow-up scam known as “ProfitClicking,” for instance. Serial huckster “Ken Russo” also promoted Zeek and JSS/JBP — and many more schemes, including ASD and Profitable Sunrise, which the SEC described last month as a scam that may have gathered tens of millions of dollars.

But a new filing by Kenneth D. Bell, the Zeek receiver, suggests that the receivership may seek to foreclose any after-the-fact opportunities for offshore processors to duck their responsibilities to the receivership estate and for holders of the offshore accounts to benefit from Zeek after the SEC brought spectacular allegations of Ponzi- and pyramid fraud against Zeek in August 2012.

Zeek, the SEC said last year, was a $600 million fraud scheme that used at least 15 foreign and domestic financial institutions.

A forensic accounting has led Bell to believe that “both Payza and SolidTrustPay may have additional Receivership assets.”

In a report to Senior U.S. District Judge Graham C. Mullen, Bell said he is working “to investigate and seize these funds.”

And, Bell advised Mullen, “[t]o the extent these entities allowed affiliates to withdraw funds after receiving notice of the Receivership, the Receiver may seek reimbursement of indemnification for the funds from the payment service providers.”

If Bell somehow is able to foreclose chicanery involving serial Ponzi pitchmen and the scamming insiders with offshore accounts, it could go a long way toward minimizing the spread of fraud schemes over the Internet.

Bell’s April 30 filing also reveals that the receivership has recovered $291,000 from a “merchant services account reserve” that had been held by American Express for Rex Venture Group, Zeek’s parent company. At the same time, it reveals that Bell — to date — has recovered $36,000 from Zeek net winners in prelitigation settlements. That number may grow. The deadline to enter into negotiations for a prelitigation settlement is May 31.

More than anything, though, Bell’s report to the court showcases the enormous problems created by HYIP schemes. Among the problems outlined in the filing:

Potentially costly and time-consuming litigation disputes for all parties. Zeek operator Paul Burks is claiming privilege on certain matters. Some Zeek “winners” have filed motions that could slow down the refund process for Zeek victims at large.

Taxes: Zeek appears to have misclassified certain employees as independent contractors, which has tax ramifications.

Incomplete records. Because of poor records at Zeek, some members who received 1099 tax forms from the receivership received forms that showed earnings either higher or lower than actual earnings. The receivership has prepared amended 1099s for certain Zeek members.

Possible disputes with vendors. Bell’s report noted that USHBB Inc. asserted it was owed $878,856 by Zeek. USHBB produced video promos for Zeek. In September 2012, the PP Blog reported that Zeek once listed USHBB executive OH Brown as an employee. Meanwhile, USHBB once produced videos for a collapsed MLM scheme known as Narc That Car.)

Clawback litigation: In the absence of settlements, the receiver potentially could file actions that involve thousands of Zeek affiliates in possession of ill-gotten gains from the scheme.

Read the receiver’s April 30 filing. (Our thanks to the ASD Updates Blog for providing the filing.)

Visit the receivership website.